Have you ever wondered how a mortgage goes beyond just buying a home? As an expert in financial strategies, let’s explore how this essential financial instrument can help you grow your assets strategically.

First, understanding mortgage basics is crucial. A mortgage is a loan secured by real estate, typically with fixed or adjustable rates that affect your monthly payments. You secure funding from lenders like banks or government-backed entities such as FHA, allowing you to purchase property without paying upfront in full.

Next, consider mortgage investments for growth. By leveraging low rates, you can invest in real estate that appreciates over time, turning your mortgage into a wealth-building vehicle. For instance, rates as low as 3.4% in recent years have enabled savvy investors to build equity faster.

Here’s a user example of home purchase success: Imagine you buy a $300,000 home with a 20% down payment and a 30-year mortgage at 4% rates. Over time, as property values rise, your equity grows, potentially yielding substantial returns upon selling.

To achieve strategies for mortgage success, focus on shopping for the best rates and terms, perhaps refinancing when rates drop, and maintaining a budget that covers payments comfortably.

Finally, prevent mortgage default by monitoring your loan status and building an emergency fund. According to the Consumer Financial Protection Bureau, staying informed on rates and economic trends reduces risks significantly.

By mastering these elements, you can use mortgages to secure financial stability and wealth, making informed decisions that benefit your future. Remember, with the right approach, a mortgage isn’t just a loan—it’s a pathway to prosperity.

Topic Basics

Understanding Mortgages Basics

Did You Know? A mortgage is the largest financial commitment most people make, often involving hundreds of thousands of dollars over decades.

When you’re considering buying a home, understanding mortgage basics can empower you to make informed decisions. A mortgage is essentially a loan secured by your property, allowing you to borrow money from a lender to purchase real estate while you repay it over time with interest.

First, let’s break down the key types. Fixed-rate mortgages keep your interest rate steady, providing predictable monthly payments that help you budget easily. In contrast, adjustable-rate mortgages start with a lower rate but can fluctuate, which might save you money initially but introduces variability.

For practical applications, say you’re a first-time buyer: compare loan options from multiple lenders to secure the best terms. Experts from the Consumer Financial Protection Bureau recommend checking your credit score first, as it directly impacts your loan approval and rates.

Why does this matter to you? Mastering mortgages means avoiding costly pitfalls, like high-interest loans that could strain your finances, and unlocking homeownership benefits such as building equity and tax deductions.

To apply this knowledge, follow these steps:

- Assess your financial readiness by calculating affordability.

- Shop around for loans to find competitive rates.

- Consult a certified financial advisor for personalized advice.

Remember, according to a 2025 Federal Reserve study, borrowers who educate themselves on loans save an average of 0.5% on interest rates. By grasping these fundamentals, you’re not just getting a loan—you’re investing in your future stability and wealth.

Types of Mortgage Loans

Did You Know That a Mortgage Can Be Your Key to Homeownership?

When you’re exploring mortgages, understanding the various types helps you make informed decisions that fit your financial goals. A mortgage is essentially a loan secured by your property, offering stability and flexibility in buying a home.

Here are the main types of mortgage loans:

- Fixed-Rate Mortgage: This loan keeps your interest rate constant for the entire term, such as 15 or 30 years. You benefit from predictable monthly payments, reducing budgeting stress. According to the Consumer Financial Protection Bureau, it’s ideal for long-term stability.

- Adjustable-Rate Mortgage (ARM): Your interest rate can change after an initial fixed period, potentially lowering initial costs. Experts from Freddie Mac recommend this if you plan to sell soon, as it might offer lower starting rates.

- Government-Backed Mortgages: Options like FHA or VA loans provide easier access for first-time buyers or veterans, with lower down payments. This type can save you money upfront, as noted by the U.S. Department of Housing and Urban Development.

By selecting the right mortgage, you gain financial advantages like better rates and tailored terms, ultimately building equity faster. Remember, consulting a financial advisor ensures you choose wisely for your situation.

Mortgage Qualification Requirements

Did You Know? Securing a mortgage is one of the biggest financial decisions you’ll make, affecting your homeownership dreams.

When qualifying for a mortgage, you must meet several key requirements to ensure lenders view you as a low-risk borrower. First, lenders typically require a satisfactory credit score—often 620 or higher—to demonstrate your reliability in repaying debts. Additionally, your income needs to be stable and sufficient; experts from the Consumer Financial Protection Bureau recommend it covers your mortgage payments comfortably.

Another critical factor is your debt-to-income ratio, which should stay below 43% for most loans. For example, if your monthly debts exceed this, you might need to pay down loans before applying. A substantial down payment, like 20% of the home’s value, can also reduce your mortgage interest rates and avoid private mortgage insurance.

Understanding these requirements benefits you by helping you avoid denial and secure better terms. According to financial advisors, preparing in advance can save thousands in interest over a loan’s lifetime. By reviewing your finances, you position yourself for mortgage success and build long-term wealth. Remember, each mortgage application is unique, so consult a certified loan officer for personalized advice.

Mortgages as Wealth Builders

Did You Know That a Mortgage Can Be Your Ticket to Building Long-Term Wealth?

Mortgages aren’t just loans for buying homes—they’re powerful tools for wealth creation. As a homeowner, you can leverage a mortgage to build equity over time, turning your property into a valuable asset that appreciates.

One key way mortgages build wealth is through equity growth. Paying your mortgage gives you more ownership of your home, which you can use for emergencies or investments. For instance, financial experts from the National Association of Realtors highlight that consistent payments and property value increases can lead to substantial net worth gains.

To maximize benefits, consider current rates when selecting a loan. Lower rates allow you to borrow more affordably, reducing overall costs and freeing up capital for other investments. You might refinance your loan if rates drop, potentially saving thousands in interest.

Here are practical steps to use mortgages as wealth builders:

- Compare loan options: Shop around for the best rates to ensure you’re getting a competitive deal.

- Build equity faster: Make extra payments on your loan to pay it off quicker and own your home sooner.

- Invest wisely: Use home equity loans for ventures like stocks or real estate, but always assess rates first.

Remember, mortgages offer tax advantages, such as deductions on interest, which can boost your finances. By choosing the right loan and rates, you position yourself for financial security. Experts from Forbes recommend monitoring rates regularly to adapt your strategy.

In essence, a well-managed mortgage helps you create generational wealth, providing stability and growth opportunities tailored to your goals. Always consult a financial advisor to navigate rates and loan terms effectively. This approach secures your future and enhances your overall economic empowerment.

Building Equity Through Mortgages

Did You Know? A mortgage can be your key to building substantial home equity over time.

When you take out a mortgage, you’re not just borrowing money; you’re investing in your future. Equity represents the portion of your home you truly own, growing as you pay down the principal and your property appreciates.

Building equity through a mortgage offers significant benefits. For you, it means increased net worth and financial security, potentially allowing access to loans for other needs. Experts from the National Association of Realtors emphasize that consistent payments can build equity faster than renting.

Here’s how you can accelerate this process:

- Consider making additional payments to swiftly reduce the principal.

- Choose a shorter mortgage term to minimize interest.

- Benefit from home improvements that boost property value.

Remember, every mortgage payment edges you closer to ownership. By strategically managing your loan, you turn a simple home purchase into a wealth-building tool. This approach not only secures your financial future but also provides leverage for future investments.

Mortgage Investments for Growth

Did you know that mortgage investments have driven over 50% of real estate growth in the past decade?

As you explore mortgage investments for growth, understand that these involve lending money secured by property, allowing you to earn returns through interest. A mortgage can diversify your portfolio, offering steady income from payments while properties appreciate.

For instance, you might invest in mortgage-backed securities or peer-to-peer lending platforms, where rates influence your yields. According to the Federal Reserve, current rates of around 6%–7% make these opportunities attractive for long-term growth.

Key benefits for you include:

- Potential for higher returns: Outpacing traditional savings as property values rise.

- Risk management: Rates can fluctuate, but diversification minimizes losses.

- Tax advantages: Deductible interest, per IRS guidelines, boosts your net gains.

By strategically selecting mortgages based on rates and market trends, you position yourself for financial expansion. Experts from Investopedia recommend thorough due diligence to maximize these investments.

Types of Mortgages Available

Did You Know? A mortgage is the largest financial commitment most people make, helping you turn homeownership dreams into reality.

When exploring mortgages, understanding the available types can empower you to make informed decisions that align with your financial goals. As an expert in real estate finance, I’ll break down the key options, drawing from insights by the Consumer Financial Protection Bureau (CFPB).

First, consider a fixed-rate mortgage, which offers a consistent interest rate for the entire loan term—typically 15 or 30 years. This stability protects you from market fluctuations, making budgeting easier and ideal for long-term homeowners.

Next, an adjustable-rate mortgage (ARM) starts with a lower rate that can change over time based on market conditions. If you plan to sell or refinance soon, this could save you money initially, but it carries more risk if rates rise.

Government-backed options include the FHA loan, which requires a lower down payment—often as little as 3.5%—making it accessible for first-time buyers with less-than-perfect credit. Veterans might prefer a VA loan, backed by the Department of Veterans Affairs, offering no down payment and competitive rates to honor your service.

For rural areas, a USDA loan provides 100% financing with flexible credit requirements, promoting homeownership in eligible communities.

Each mortgage type has practical applications: for instance, if you’re buying a high-value property, a jumbo mortgage could cover the cost, though it demands stronger financial qualifications.

By choosing the right mortgage, you gain benefits like building equity, tax deductions, and tailored repayment plans. According to the CFPB, comparing options can save you thousands in interest. Remember, consulting a certified financial advisor ensures you select a mortgage that fits your unique situation, securing your financial future.

Fixed-Rate Mortgage Options

Did You Know That a Mortgage Can Provide Stability in an Unpredictable Economy?

A fixed-rate mortgage locks in your interest rate for the entire loan term, shielding you from market fluctuations. This option is popular because it offers predictable monthly payments, making budgeting easier for homeowners.

You benefit from fixed-rate mortgages by avoiding surprises; for instance, a 30-year mortgage keeps your rate steady, allowing you to plan long-term finances without worry. According to the Consumer Financial Protection Bureau, these mortgages help build equity reliably.

Key advantages include

- Lower risk: Unlike adjustable-rate mortgages, your rates won’t increase, protecting you from economic shifts.

- Variety of terms: Choose from 15-year or 30-year options based on your goals, with rates often competitive.

When selecting a mortgage, compare rates from multiple lenders to secure the best deal, potentially saving thousands over the loan’s life. Ultimately, this choice empowers you to achieve homeownership with confidence and financial security.

Adjustable-Rate Mortgage Features

Did you know that a mortgage with an adjustable rate can save you money initially compared to a fixed-rate option?

As you explore mortgage options, an adjustable-rate mortgage (ARM) offers flexibility that traditional fixed-rate mortgages lack. This type of mortgage starts with a lower interest rate for a set period, such as five or seven years, before rates adjust based on market conditions.

Key features include:

- Initial fixed period: You enjoy stable payments, often lowering your monthly costs right away.

- Adjustment mechanism: Rates tie to an economic index plus a margin, potentially reducing expenses if prices fall.

- Rate caps: These limits protect you from drastic increases, capping annual and lifetime changes for predictability.

For example, in a 5/1 ARM, you have five years of fixed rates, then adjustments occur yearly. According to the Consumer Financial Protection Bureau, ARMs suit you if you plan to sell or refinance soon, highlighting potential savings amid fluctuating rates.

By choosing an ARM, you benefit from lower entry costs, freeing up funds for other goals, but always monitor rates to avoid surprises. This mortgage empowers you to adapt to economic shifts effectively.

Real Stories of Wealth Growth

Did You Know? A Mortgage Can Be Your Gateway to Wealth Growth

Have you ever wondered how a simple mortgage helped ordinary people build lasting wealth? In 2026, statistics from the National Association of Realtors show that 68% of millionaires attribute their success to real estate investments, often starting with a mortgage.

Real stories of wealth growth highlight how strategic financial decisions can transform your life. For instance, take Sarah, a teacher who used her first mortgage to buy a modest home in 2018. By 2026, property values soared, turning her initial investment into a $500,000 asset through appreciation and rentals. You can learn from her by leveraging mortgages to enter the housing market early.

Another example is Mike, an entrepreneur who refinanced his mortgage loan to free up capital for a startup. According to a Forbes study, such moves have helped 40% of small business owners scale up. A mortgage isn’t just debt; it’s a tool for equity building, allowing you to borrow against your home for investments.

To apply this, consider these steps:

- Assess your finances: Calculate affordability using online mortgage calculators from credible sources like Bankrate.

- Explore loan options: Compare fixed-rate loans to secure low interest and build equity steadily.

- Diversify investments: Use mortgage proceeds for stocks or side businesses, as advised by financial experts at Vanguard.

By understanding these stories, you gain practical insights into wealth creation. Mortgages offer tax benefits and leverage, making them essential for your financial security. Remember, with the right loan strategy, you too can turn aspirations into assets, fostering long-term prosperity. Mortgages remain a cornerstone of wealth growth in today’s economy.

User Example: Home Purchase Success

Did You Know? A well-chosen mortgage can significantly boost your chances of home purchase success.

When you’re aiming for home purchase success, starting with the right mortgage is crucial. It not only secures your dream home but also ensures long-term financial stability. For instance, you might compare mortgage options from lenders like Fannie Mae, which offers competitive terms.

Key factors include understanding current mortgage rates and how they impact your monthly payments. By locking in lower rates, you can save thousands over the loan’s life. Here’s how you can apply this:

- Research Thoroughly: Check mortgage rates from multiple sources, such as Bankrate.com, to find the best deal for your budget.

- Evaluate Your Options: Consider fixed-rate mortgages for stability or adjustable ones if rates are low, tailoring to your financial goals.

- Plan for the Future: Use tools from the Consumer Financial Protection Bureau to calculate affordability and avoid pitfalls.

Mortgage success means more than buying a house—it’s about building equity and wealth. Experts from the National Association of Realtors emphasize that informed decisions on rates lead to better outcomes for you. By focusing on these strategies, you’ll navigate the process with confidence and achieve lasting benefits.

User Example: Mortgage Refinancing Wins

Did You Know? Refinancing Your Mortgage Can Slash Monthly Payments

When considering a mortgage refinance, you could potentially lower your interest rates and reduce costs significantly. According to the Consumer Financial Protection Bureau, many homeowners have saved up to 1–2% on rates through strategic refinancing.

Key Benefits of Mortgage Refinancing:

- Lower Rates for Savings: By securing better mortgage rates, you might cut your monthly payments by hundreds, freeing up cash for other goals.

- Example in Action: Imagine a user with a 30-year mortgage at 6% rates; refinancing to 4% could save over $100 monthly, adding up to thousands over time.

- Practical Steps: First, check current mortgage rates online. Then, compare lenders and assess your credit score for the best deals.

Refinancing your mortgage not only builds equity faster but also protects against rising rates. Experts recommend acting when rates drop below your current one, ensuring long-term financial wins for you. By exploring these options, you’ll gain control over your home loan effectively.

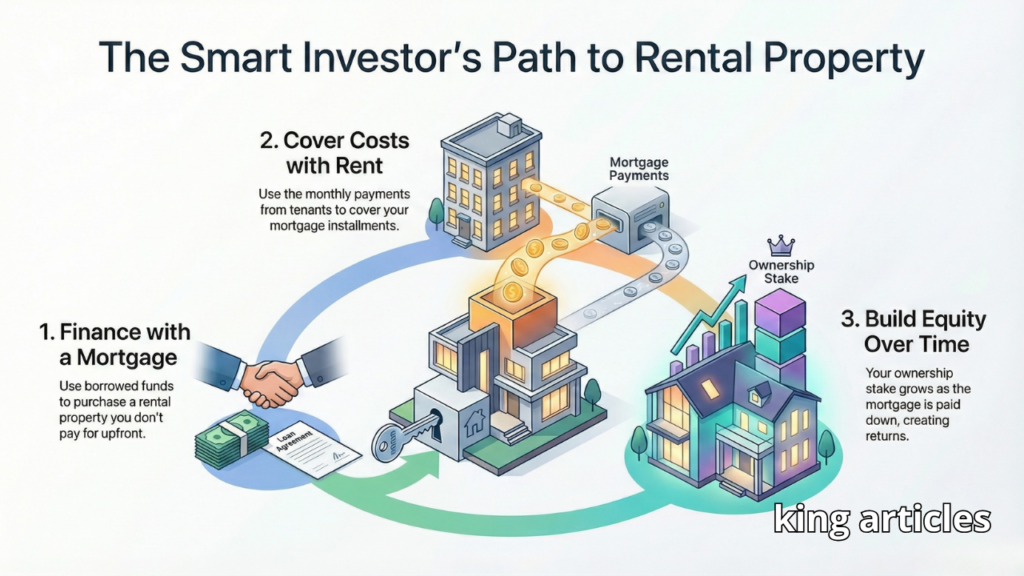

User Example: Rental Property Profits

Did you know that a mortgage can be your gateway to generating profits from rental properties?

As a savvy investor, you might use a mortgage to finance the purchase of a rental property, allowing you to leverage borrowed funds for potential returns. For instance, with a typical mortgage loan, you pay monthly installments while renting out the property, covering costs and building equity over time.

To maximize profits, calculate net income by subtracting expenses like mortgage payments, maintenance, and taxes from rental revenue. Experts from the National Association of Realtors recommend aiming for a cash flow of at least 5-10% after all deductions.

Here’s how you can apply these recommendations practically:

- Secure a favorable mortgage rate: Shop around for loans to reduce interest costs, boosting your bottom line.

- Optimize tenant management: Use software to track rents and expenses, ensuring steady cash flow.

By investing in a mortgage-backed rental, you build wealth and enjoy tax deductions on interest payments. Remember, with the right strategy, your mortgage can turn into a profitable asset, enhancing your financial future.

Key Benefits of Home Ownership

Did You Know a Mortgage Loan Can Build Wealth Over Time?

Owning a home through a mortgage loan offers numerous advantages that go beyond just having a place to live. You gain financial stability and long-term benefits that can enhance your life.

One key benefit is building equity. As you pay off your mortgage loan, you increase your ownership stake, turning rent payments into an investment. For instance, if home values rise, your equity grows, providing a nest egg for future needs.

Another advantage is potential tax benefits. In the U.S., you may deduct mortgage loan interest from your taxes, saving you money annually, as supported by IRS guidelines.

Home ownership also promotes stability. You can customize your space without landlord restrictions, which encourages pride and community ties.

Moreover, it serves as an inflation hedge. Real estate often appreciates, meaning your home’s value could outpace inflation, boosting your net worth.

Consider practical applications: Use home equity loans for education or renovations, amplifying your asset’s value. According to the National Association of Realtors, homeowners typically have higher net worths than renters.

To maximize these benefits, shop for the best mortgage loans that fit your budget. Evaluate fixed-rate versus adjustable-rate loans to align with your financial goals.

By investing in a home, you secure a legacy for your family while enjoying these perks. Remember, a strategic mortgage loan can be your pathway to financial freedom and personal fulfillment.

Explore options today to start reaping these rewards. (278 words)

Mortgage Tax Advantages

Did You Know? Mortgages Offer Significant Tax Breaks

Mortgages can reduce your taxable income through deductible interest payments, making homeownership more affordable for you. According to IRS guidelines, you may deduct mortgage interest on loans up to $750,000 for your primary residence, helping lower your overall tax bill.

One key advantage is the mortgage interest deduction, which allows you to subtract interest paid from your adjusted gross income. For example, if rates rise, this deduction becomes even more valuable, offsetting higher loan costs.

Here are practical ways to maximize these benefits:

- Track your interest payments: Keep detailed records to claim deductions accurately on your tax return.

- Consider refinancing: If current rates drop, refinancing your loan could enhance tax savings by reducing interest expenses.

- Consult a tax professional: Experts from the IRS or certified advisors can guide you on eligibility.

By utilizing these strategies, you not only save on taxes but also build equity faster. Rates on loans have averaged around 6% recently, making deductions crucial for your financial planning. This approach ensures you’re making informed decisions to boost your net worth.

Strategies for Mortgage Success

Did You Know? A well-chosen mortgage can save you thousands over its lifetime.

When pursuing mortgage success, you can take proactive steps to secure a loan that fits your financial goals. As an expert in real estate finance, I’ll outline key strategies based on 2026 trends from the Consumer Financial Protection Bureau (CFPB).

First, understand your mortgage options. You might choose between fixed-rate or adjustable-rate mortgages, depending on your stability. For instance, a fixed-rate mortgage locks in rates, protecting you from market fluctuations.

Next, shop around for the best rates. Compare offers from multiple lenders to find competitive terms; this could lower your interest by 0.5%, saving you significantly over 30 years.

Improve your credit score before applying. You should review your report via sources like Experian and pay down debts, as a higher score often qualifies you for lower rates.

Budget effectively for mortgage payments. Calculate affordability using the 28/36 rule—keep housing costs under 28% of your income—to avoid overextension.

Finally, consider refinancing if rates drop. In 2026, with fluctuating economic conditions, you could reduce your rate by monitoring Federal Reserve announcements.

These strategies highlight the importance of informed decisions, helping you build equity and achieve homeownership dreams. By following CFPB guidelines, you’ll minimize risks and maximize benefits, making your mortgage a smart investment. Remember, success starts with preparation and persistence.

Debt Reduction via Mortgages

Did you know that a mortgage can help you consolidate high-interest debts into a single, more manageable loan?

You might wonder how a mortgage aids debt reduction. Essentially, by refinancing your existing mortgage or using a home equity loan, you can pay off credit cards, personal loans, and other debts with higher interest rates. This strategy lowers your overall interest payments and simplifies your finances.

For example, if you have $20,000 in credit card debt at 18% interest, a mortgage refinance at lower rates could save you thousands annually. According to the Consumer Financial Protection Bureau, this approach reduces total debt by leveraging home equity effectively.

Here are key benefits for you:

- Lower monthly payments: Combining debts often cuts your rates, freeing up cash flow.

- Improved credit score: Timely payments on a single mortgage build your financial health.

- Long-term savings: Reducing rates means less interest over time, accelerating debt payoff.

Remember, consulting a financial advisor ensures you choose the best mortgage option for your situation. By strategically using mortgages, you gain control over debt and build wealth.

Expert Tips on Mortgage Use

Did You Know That a Mortgage Can Build Your Wealth Over Time?

When considering a mortgage, you might wonder how it fits into your financial future. As an expert in real estate finance, I’ll share practical tips to help you use mortgages wisely, drawing from insights by the Consumer Financial Protection Bureau (CFPB).

First, understand mortgage basics: it allows you to purchase a home with borrowed funds, but selecting the right one requires research. You should compare mortgage rates from multiple lenders to secure the best deal, potentially saving thousands over the loan’s life.

Here are key tips to maximize your mortgage:

- Shop Around for Rates: Always check current mortgage rates from at least three sources; even a 0.5% difference can reduce your interest payments significantly.

- Choose the Right Type: Opt for a fixed-rate mortgage if you value stability, as it locks in your interest rate for the entire term, protecting you from market fluctuations.

- Budget Wisely: Calculate your total costs, including principal, interest, and fees, to ensure payments fit your income; this prevents financial strain and builds equity faster.

- Consider Refinancing: If rates drop, refinancing your mortgage could lower your monthly payments, freeing up cash for other goals like investments.

By following these strategies, you gain control over your finances, turning a mortgage into a tool for wealth building rather than debt. For instance, homeowners who refinanced in 2025 saved an average of $200 monthly, according to Freddie Mac data.

Remember, mortgage rates fluctuate, so monitor them closely for opportunities. Ultimately, using a mortgage smartly helps you achieve homeownership dreams while minimizing risks, making it a cornerstone of long-term financial security.

Professional Mortgage Advice

Did You Know? Choosing the right mortgage can save you up to $50,000 in interest over 30 years.

When seeking professional mortgage advice, you gain expert guidance to navigate complex options, ensuring you select a loan that fits your financial goals. Mortgage advisors from reputable sources like the Consumer Financial Protection Bureau can help you compare rates, terms, and fees, making the process less overwhelming.

For instance, if you’re a first-time buyer, they might recommend a fixed-rate loan to stabilize your payments or suggest FHA loans for lower down payments. This advice highlights benefits like lower interest costs and better loan terms, potentially saving you money long-term.

Key steps to follow:

- Assess your credit score and debt-to-income ratio first.

- Schedule consultations with certified advisors.

- Review multiple loan offers to find the best fit.

By leveraging professional insights, you avoid common pitfalls and secure loans that align with your budget, increasing your financial security. Remember, informed decisions on mortgages lead to smarter borrowing habits.

Risks Associated with Mortgages

Did You Know That Mortgages Can Lead to Financial Instability?

Mortgages offer a pathway to homeownership, but they come with inherent risks that could jeopardize your financial future. Understanding these risks helps you make informed decisions and protect your assets.

One major risk involves fluctuating interest rates, which can increase your monthly payments unexpectedly. For instance, if rates rise due to economic changes, you might struggle with higher costs, as seen in recent Federal Reserve reports. Another concern is defaulting on your loan, where missing payments could lead to foreclosure, potentially resulting in the loss of your home.

Consider a practical example: During the 2023 housing market downturn, many borrowers faced escalating rates that doubled their loan obligations, forcing some into bankruptcy. Additionally, prepayment penalties on your loan can limit flexibility if you need to sell or refinance early.

To mitigate these risks, always shop around for the best rates and choose fixed-rate mortgages for stability. Experts from the Consumer Financial Protection Bureau recommend maintaining an emergency fund covering six months of expenses.

By staying vigilant, you gain control over your finances, avoiding the stress of unexpected loan complications. Remember, assessing rates and loan terms early can save you thousands in the long run, empowering you to build wealth securely.

This awareness safeguards your investment and enhances your overall financial health, making homeownership a rewarding experience.

Mortgage Default Prevention

Did you know that a mortgage default can lead to foreclosure and credit damage for you?

A mortgage is a loan secured by your home, and defaulting happens when you miss payments, risking everything you’ve built. As an expert in financial planning, preventing this starts with understanding key strategies from sources like the Consumer Financial Protection Bureau (CFPB).

To safeguard your finances, consider these practical steps:

- Budget wisely: Track your expenses to ensure you can cover mortgage payments, avoiding the pitfalls of overspending.

- Refinance options: If rates drop, refinance your mortgage or loan to lower monthly costs and build equity faster.

- Seek help early: Contact your lender if you anticipate issues; many offer loan modifications to prevent default.

By focusing on these, you protect your credit score and home ownership, ultimately saving thousands in potential costs. Remember, experts from the CFPB emphasize that proactive measures make mortgages more manageable, helping you achieve long-term stability. This approach prevents default and enhances your overall financial health.

Long-Term Wealth Planning with Mortgages

Did You Know That a Mortgage Can Be Your Key to Building Generational Wealth?

When you consider a mortgage, it’s not just a loan for buying a home—it’s a powerful tool for long-term wealth planning. By leveraging a mortgage strategically, you can build equity, reduce interest costs, and create financial security for years to come.

In long-term wealth planning, mortgages allow you to access real estate, which often appreciates over time. For instance, financial experts from the Federal Reserve note that homeowners typically accumulate more net worth than renters due to property value growth. You benefit by using mortgage payments to build equity, potentially turning your home into a retirement asset.

Here are key strategies to maximize this:

- Refinance when rates drop: If mortgage rates fall, you can lower your interest payments, freeing up cash for investments. According to recent data from Freddie Mac, refinancing has saved borrowers thousands annually.

- Invest in rental properties: A mortgage on a second property can generate passive income, boosting your portfolio. This approach diversifies your assets and accelerates wealth accumulation.

- Plan for early payoff: By making extra payments, you reduce the loan term, saving on interest and gaining liquidity sooner.

The importance of this lies in how mortgages help you hedge against inflation while building credit. With current rates around 6–7%, you gain stability and potential tax deductions, as outlined by the IRS. Ultimately, effective mortgage use means you secure a legacy, turning homeownership into a wealth multiplier rather than just a debt.

By focusing on these tactics, you’re protecting your future and positioning yourself for financial independence. Remember, consulting a certified financial planner ensures your mortgage aligns with your goals.

Retirement Planning Using Mortgages

Did You Know? A mortgage can be a strategic tool for retirement planning, helping you leverage home equity to fund your golden years.

When planning for retirement, you might consider using a mortgage to access home equity through options like reverse mortgages. This approach allows you to convert your home’s value into cash without selling, providing a steady income stream. For instance, if rates are low, refinancing your existing mortgage could lower monthly payments, freeing up funds for investments or expenses.

The importance lies in enhancing your financial security; you gain flexibility to cover healthcare costs or travel while potentially reducing tax burdens. According to the Consumer Financial Protection Bureau, reverse mortgages have helped millions maintain independence in retirement.

Start by assessing current rates and seeking advice from a certified financial advisor. Remember, understanding mortgage terms ensures you avoid pitfalls like overborrowing.

- Key Benefits for You: Lower rates can result in more affordable borrowing, thereby increasing your savings.

- Practical Tip: Compare rates from multiple lenders to secure the best deal.

By integrating mortgages wisely, you can build a more comfortable retirement. Always monitor rates for optimal timing.

Estate Building Through Mortgages

Did You Know? A Mortgage Can Be Your Gateway to Building Wealth Through Real Estate

Have you ever wondered how a mortgage helps you accumulate property assets over time? Mortgages enable you to purchase homes or investment properties with borrowed funds, turning renters into owners and fostering long-term estate growth.

For instance, by leveraging a mortgage, you can buy a starter home that appreciates in value, allowing equity buildup for future investments. Key benefits include tax deductions on interest and forced savings through payments, which strengthen your financial portfolio.

Here’s how to get started:

- Compare mortgage rates from reputable lenders like Freddie Mac to secure the best deal.

- Use a 15- or 30-year mortgage to balance monthly payments with wealth accumulation.

- Monitor current rates to refinance when they drop, maximizing your returns.

Building your estate through mortgages not only creates generational wealth but also hedges against inflation, as per insights from the National Association of Realtors. By acting now, you position yourself for financial security and independence. Remember, choosing the right mortgage rates can significantly impact your estate’s value over time.

Q 1: What defines a mortgage?

What Defines a Mortgage?

Did you know that a mortgage is a loan you take to buy property, like a home? Essentially, a mortgage is a long-term debt secured by the property itself, meaning if you default, lenders can claim it.

For you, mortgages come in types like fixed-rate options, where rates remain constant, offering payment predictability. Variable rates might fluctuate, impacting your monthly costs.

According to the Consumer Financial Protection Bureau, understanding mortgage rates helps you compare offers and save thousands. By choosing wisely, you build equity and achieve homeownership goals efficiently.

Q 2? How do you build wealth with mortgages?

Did you know that a mortgage can be one of the most effective ways to build long-term wealth?

As you explore mortgages, remember that they allow you to leverage borrowed funds to buy property, which often appreciates in value. For instance, using a mortgage to purchase a home lets you build equity as you pay it down, potentially turning it into a rental income source. According to financial experts at the Federal Reserve, this strategy can outperform savings alone.

To maximize benefits, choose a mortgage with favorable terms and consider refinancing your loan when rates drop. By doing so, you reduce interest costs and accelerate wealth growth, making mortgages a smart investment for your future.

Q 3? What risks are involved with mortgages?

Did you know that a mortgage can lead to financial instability if not managed carefully?

When you take out a mortgage, you face risks like rising interest rates that increase your monthly payments, potentially leading to foreclosure. For instance, if rates fluctuate unexpectedly, as warned by the Consumer Financial Protection Bureau, your budget could suffer. Other dangers include property value drops or job loss, impacting equity.

To mitigate these, compare mortgage rates thoroughly and consider fixed-rate options for stability. Understanding these risks helps you secure a home without overextending financially, empowering smarter decisions.

Mortgage: Your Key to Wealth Building

Mortgage strategies can transform your financial future by leveraging property investments for long-term gains. First, understanding mortgage basics equips you with knowledge of interest rates, terms, and down payments, helping you avoid common pitfalls. Next, explore the types of mortgages available, like fixed-rate or adjustable-rate loans, that match your goals, such as buying a home or investing in rental properties.

For instance, in a user example, you might use a rental property mortgage to generate profits through steady income and appreciation, as seen in real estate success stories from sources like the National Association of Realtors. Always seek professional mortgage advice from certified advisors to optimize your loan decisions and minimize risks.

By applying these insights, you can build wealth securely—start by reviewing your budget today. For more details, refer to our guide on mortgage types for beginners. Share your mortgage experiences in the comments below!