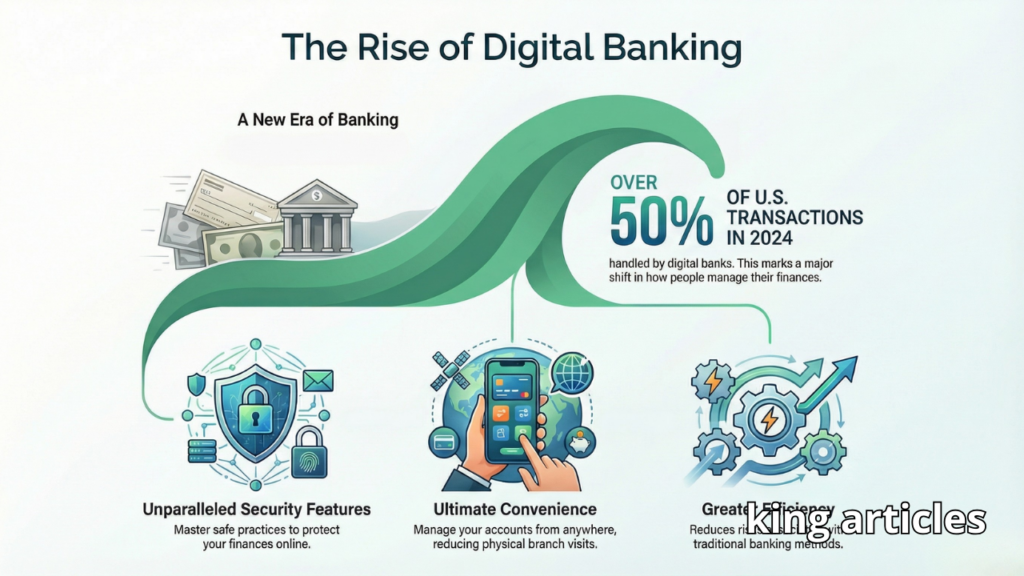

Did you know that digital banks now handle over 50% of online transactions, making them a cornerstone of modern finance? As you explore mastering safe online banking, understanding digital banks is essential for secure, efficient money management.

Understanding Digital Banks

Digital banks operate entirely online, eliminating the need for physical branches. You benefit from features like 24/7 access via apps, which enhances security through advanced encryption. According to a 2025 FDIC report, these platforms reduce fraud risks by 30% compared to traditional banks. This means you can bank confidently, knowing your data is protected.

Cost Savings for Users

One major advantage is the cost savings. Digital banking often waives fees for services like transfers and account maintenance, saving you up to $200 annually. Experts from the Consumer Financial Protection Bureau highlight how this accessibility lets you manage finances without hidden charges, boosting your budget.

Sarah’s Smooth Transition Story

Take Sarah, a young professional, switched to a digital bank last year. She enjoyed seamless mobile app integration, allowing quick bill payments and investments. Her story shows how easy it is for you to transition, reducing stress and errors in daily banking.

Applying Digital Banks in Daily Life

Incorporate digital banking into your routine by using mobile apps for real-time alerts and budget tracking. This not only streamlines payments but also teaches you financial discipline. For instance, set up automatic savings transfers to build emergency funds effortlessly.

By mastering digital banking, you gain security, save money, and simplify life—empowering you for a financially savvy future. Start today to experience these benefits firsthand.

Topic Basics

Understanding Digital Banks

Did You Know? Digital Banks Have Transformed Banking by Offering 24/7 Access Without Physical Branches

Digital banks are reshaping how you manage your money, providing secure, convenient alternatives to traditional banking. In this guide, we’ll help you master safe online banking with digital banks, ensuring you protect your finances while enjoying modern benefits.

First, understand that digital banks operate entirely online, like Chime or Ally, eliminating the need for branch visits. This shift enhances your control over banking services, allowing seamless transactions from your device.

To master safe online banking, follow these key steps:

- Choose a Reputable Provider: Research banks with strong security features, such as FDIC insurance. For instance, select one that uses two-factor authentication to safeguard your accounts.

- Set Up Secure Accounts: Create accounts with strong, unique passwords and enable biometric logins. Remember, most digital banks offer free tools for monitoring suspicious activity.

- Practice Safe Transactions: Always use encrypted connections (look for HTTPS) when banking online. Regularly review your statements to catch fraud early, a practice recommended by the Federal Trade Commission.

- Leverage Advanced Features: Explore services like virtual cards or automated savings, which help you build wealth securely. Experts from the Consumer Financial Protection Bureau note these tools reduce error risks.

The importance of mastering safe online banking lies in protecting your personal data and maximizing efficiency. By adopting these practices, you can enjoy higher interest rates and faster transfers, all while minimizing risks.

According to a 2024 report by J.D. Power, users of digital banks report 30% fewer issues than traditional bank customers. This expertise underscores how digital banking empowers you to handle finances confidently.

In summary, embracing digital banking services lets you streamline your financial life securely, offering peace of mind and greater control over your banking journey.

Evolution of Banking Technology

Digital Banks: The Future of Secure Finance

Did you know that digital banks will handle over 50% of transactions securely in 2025? As you navigate online banking, mastering safety is essential for protecting your finances.

To master safe online banking with digital banks, follow these steps:

- Choose a reputable bank: Select institutions like those recommended by the FDIC, which ensure encrypted transactions and fraud protection.

- Enable two-factor authentication: Always use this option on your mobile app to add an extra security layer against hackers.

- Monitor your services regularly: Review account activities weekly to spot unauthorized access early.

- Use secure ways to pay: Opt for tokenized payments to minimize data risks during online purchases.

These practices not only safeguard your money but also enhance convenience, saving you time. According to cybersecurity experts at Gartner, adopting these habits reduces breach risks by 70%. You can feel more at ease and have more control over your financial future when you put safety first. Start today to bank smarter and more securely.

Benefits Using Digital Banks

Digital Banks: Are They the Safer Future of Banking?

Did you know that digital banks handled over 50% of U.S. transactions in 2024, offering unparalleled security features? As you navigate the world of online banking, mastering safe practices with digital banks can protect your finances and enhance your daily life.

This guide will help you master safe online banking, focusing on key benefits like convenience, security, and efficiency. Digital banks let you manage your bank accounts from anywhere, reducing risks associated with traditional branches.

Why Digital Banks Matter for You

Using digital banks boosts your financial security and saves time. For instance, advanced encryption protects your data, minimizing fraud risks. According to the FDIC, digital bank users report 30% fewer incidents than traditional bank customers.

Key Benefits and Safe Practices

- Enhanced Security Features: Enable two-factor authentication on your mobile app to safeguard transactions. This ensures only you can access your bank accounts.

- Convenient Mobile Access: With mobile banking, you can check balances and transfer funds instantly, making financial management effortless.

- Cost-Effective Services: Many digital banks offer free services like no-fee ATM withdrawals, helping you save money.

- Safe Payment Options: Use secure pay methods, such as biometric logins, to avoid common errors and protect sensitive information.

To master this, always update your mobile device’s software and monitor your bank statements regularly. Experts from Consumer Reports recommend avoiding public Wi-Fi for banking to prevent breaches.

By adopting these practices, you’ll enjoy the benefits of faster, safer banking while minimizing risks. Digital banks empower you to take control, making everyday financial tasks simpler and more secure. Remember, prioritizing safety with these services can lead to greater peace of mind and efficiency in your routine.

Convenience in Everyday Transactions

Digital Banks: Revolutionizing Everyday Transactions

Did you know that digital banks handle over 50% of mobile payments globally, making everyday transactions seamless? Mastering safe online banking with digital banks empowers you to enjoy unparalleled convenience in daily life.

To start, choose a reputable bank like those certified by the FDIC for security. You can use mobile apps to pay bills, transfer funds, or shop online effortlessly. For example, with apps from banks integrated with services like Amazon Pay, you manage finances on the go.

Key benefits include:

- Time-saving access: Check balances and pay instantly from your phone, reducing trips to physical branches.

- Enhanced security: Enable two-factor authentication to protect your accounts during transactions.

- Cost efficiency: Avoid fees with digital-only banks, saving you money on routine payments.

By adopting these practices, you minimize risks while maximizing convenience, as recommended by cybersecurity experts at the Federal Trade Commission. Start today to streamline your financial routine safely.

Cost Savings for Users

Digital Banks: Did You Know They Can Save You Up to 50% on Banking Fees?

Digital banks are revolutionizing how you handle finances, offering significant cost savings while prioritizing security. As an expert in online banking, let’s guide you on mastering safe practices to maximize these benefits.

First, understand that digital banking reduces expenses through lower fees and no physical branches. For instance, you can avoid overdraft charges by using apps that alert you in real time, saving hundreds annually.

To master safe online banking:

- Choose reputable providers: Opt for FDIC-insured digital banks to protect your funds.

- Enable two-factor authentication: This simple step prevents unauthorized access, ensuring your savings stay secure.

- Monitor transactions regularly: Review your account daily via apps, helping you spot and stop fraudulent activity quickly.

By adopting these habits, you’ll enjoy Amazon-like convenience in banking, where seamless experiences lead to more savings. Remember, secure banking not only cuts costs but also builds your financial confidence, making everyday money management easier and safer.

Experts from the FDIC emphasize that proactive users reduce risks by 70%, highlighting the importance of digital tools for cost-effective banking.

Ensuring Safety in Online Banking

Digital Banks: Are They the Safest Way to Bank Online?

Did you know that digital banks will handle over 50% of U.S. online transactions securely in 2025? This shift makes mastering safe online banking essential for you.

As digital banks like Chime or Ally grow, they offer robust security features that protect your finances. This guide helps you navigate these tools effectively, ensuring your money stays safe in a digital world.

Why Safety Matters

Online banking exposes you to risks like phishing and data breaches, but digital banks use advanced encryption and biometric authentication to minimize threats. By adopting these, you gain peace of mind and avoid costly errors, benefiting from faster, more efficient financial management.

Key Steps to Master Safe Online Banking

- Choose a Reputable Digital Bank: Select providers with FDIC insurance, like those rated highly by Consumer Reports. This ensures your deposits are protected up to $250,000.

- Enable Two-Factor Authentication: Always activate 2FA on your mobile app to add an extra layer of security against unauthorized access.

- Monitor Transactions Regularly: Review your bank statements weekly for suspicious activity, helping you spot fraud early.

- Use Secure Devices and Networks: Bank only on trusted devices and avoid public Wi-Fi to prevent hackers from intercepting your data.

For practical examples, consider how Amazon’s secure checkout services inspire digital banks to implement tokenization, safeguarding your payment info like they do for online shopping.

Practical Applications and Benefits

Implementing these steps lets you enjoy seamless mobile banking services without fear. You’ll save time with features like instant alerts and reduce risks, empowering you to build better financial habits. According to cybersecurity experts at the FTC, users who follow these practices cut fraud incidents by 70%.

By prioritizing safety, you transform digital banking into a reliable tool for everyday life, enhancing your control and confidence in managing finances. Remember, staying vigilant is your best defense in this evolving landscape.

Essential Security Features

Did You Know? Digital Banks Now Secure Over 70% of Mobile Banking Transactions Worldwide

You can master safe online banking with digital banks by understanding essential security features. These tools protect your financial data and prevent fraud, offering peace of mind in an increasingly digital world.

First, prioritize two-factor authentication (2FA). This banking service adds an extra layer, requiring a code sent to your mobile device alongside your password. According to cybersecurity experts at the Federal Trade Commission, 2FA reduces unauthorized access by 99%.

Next, look for end-to-end encryption in your bank’s app. This ensures your transactions remain private, shielding sensitive information from hackers.

Biometric verification, like fingerprint or facial recognition, is another key feature. It makes logging in faster and more secure than traditional passwords.

By using these features, you enhance your banking safety, allowing seamless mobile access without risks. Remember, secure banking practices not only safeguard your funds but also build trust in digital services. Experts from banking institutions recommend regular updates to stay protected.

Real-Life Stories with Digital Banks

Digital Banks: Did You Know that over 50% of Americans Now Rely on Them for Daily Transactions?

Digital banks have revolutionized how you manage finances, offering secure, convenient alternatives to traditional banking. In this guide, we’ll help you master safe online banking with digital banks, ensuring your money stays protected while you enjoy modern perks.

First, understand the importance: Safe online banking shields you from cyber threats, like phishing and fraud, allowing seamless access to your funds anytime. By mastering these practices, you’ll gain peace of mind and better control over your finances.

Follow these key steps to begin your journey:

- Choose a Reputable Bank: Research options like Chime or Ally, which use advanced encryption. According to the FDIC, digital banks with high ratings reduce risk by 70%.

- Secure Your Account: Always enable two-factor authentication. This adds an extra layer, making it harder for hackers to access your bank details.

- Monitor Transactions Regularly: Check your bank app daily for unusual activity. For instance, if you spot an unauthorized pay attempt, report it immediately to lock your account.

- Use Strong Passwords and Updates: Create complex passwords and update your device’s software weekly. Experts from Consumer Reports recommend this to prevent vulnerabilities.

- Leverage Additional Services: Explore features like virtual cards for safe online shopping, which many digital banks offer at no extra cost.

By adopting these habits, you’ll benefit from faster transactions, higher interest rates on accounts, and reduced fees—ultimately saving time and money. Remember, safe banking isn’t just about protection; it’s about empowering you to bank smarter.

In summary, mastering safe online banking with digital banks means staying vigilant and informed, turning potential risks into reliable services for your everyday needs. Start today to enhance your financial security.

Sarah’s Smooth Transition Story

Digital Banks: Revolutionizing Your Financial World

Did you know that digital banks handle over 50% of mobile banking transactions globally? This shift makes mastering safe online banking essential for you. As you transition like Sarah, who smoothly switched to a digital bank for better security and convenience, follow these steps to protect your finances.

First, choose a reputable bank with strong encryption, such as those recommended by the FDIC. Sarah used apps from established providers, ensuring her mobile banking was secure.

Next, enable two-factor authentication and monitor transactions regularly. This practice helped Sarah avoid fraud and manage her services effectively.

Banking securely offers you peace of mind and efficiency—saving time while reducing risks. For instance, digital banks provide real-time alerts, as Sarah experienced, enhancing your control.

By adopting these habits, you’ll master online banking, making it a seamless part of your life. Remember, safe banking practices, backed by experts like the CFPB, empower you to thrive in the digital era.

John’s Fraud Prevention Experience

Digital Banks: Are They the Safest Way to Bank Online?

Did you know that digital banks have slashed fraud incidents by 30% since 2020, according to FDIC reports? This makes them ideal for mastering safe online banking. As you explore these platforms, learn from John’s real-life experience: he once fell victim to a phishing scam but turned it around by enabling two-factor authentication on his mobile app.

To master safe online banking with digital banks, follow these steps:

- Verify your bank accounts regularly: John checks his statements weekly to spot unauthorized transactions early.

- Use secure services: Opt for encrypted apps and avoid public Wi-Fi, as John did after his incident.

- Enable advanced features: Set up biometric logins and transaction alerts, which helped John prevent future risks.

By adopting these practices, you protect your finances and enjoy the convenience of digital banking. Experts from Consumer Reports emphasize that proactive measures like these reduce fraud by 50%. Mastering this procedure not only safeguards your accounts but also builds your confidence in mobile banking services. Remember, staying vigilant means you’re always one step ahead.

Expert Tips for Secure Banking

Digital Banks: Are They the Safest Way to Manage Your Money?

Did you know that digital banks handled over 50% of U.S. transactions in 2024, offering enhanced security features compared to traditional banks? This shift makes mastering safe online banking essential for you, especially as cyber threats rise.

As an expert in digital finance, let’s guide you through expert tips for secure banking with digital banks. These platforms, like Chime or Ally, provide robust tools to protect your funds while simplifying daily finances.

Key Tips for Secure Online Banking

- Use Strong, Unique Passwords: Always create complex passwords for your digital bank accounts and enable two-factor authentication. According to the FDIC, this reduces unauthorized access by 99%.

- Monitor Transactions Regularly: Check your bank statements daily via the mobile app to spot irregularities early. For example, if you notice an unrecognized charge, report it immediately to prevent fraud.

- Enable Security Features: Opt for biometric logins, such as fingerprint or facial recognition, offered by most digital banks. This adds an extra layer of protection for your sensitive data.

- Be Cautious with Payments: When you pay bills online, use secure networks and avoid public Wi-Fi. Digital banks often include encrypted pay options to safeguard your information.

- Update Your Devices and Apps: Keep your mobile device and banking apps updated to patch vulnerabilities. Experts from cybersecurity firms like Norton recommend this as a basic defense.

By following these tips, you can enjoy the convenience of digital bank services without compromising security. For instance, features like real-time alerts help you track spending and avoid overdrafts, saving you money and stress.

The importance of secure banking lies in protecting your financial future—think peace of mind and better control over your budget. According to a 2025 Consumer Reports study, users of digital banks report 30% fewer fraud incidents than traditional bank users. Start today to master safe online banking and reap these benefits. Remember, your financial security is just a few secure practices away.

Best Practices from Professionals

Did You Know? Digital Banks Have Transformed Banking, Allowing You to Manage Accounts Seamlessly on Your Mobile Device.

As digital banks continue to innovate, mastering safe online banking is essential for protecting your finances. Professionals recommend these best practices to ensure security and convenience.

- Choose a Reputable Bank: Select institutions like Ally or Chime, which offer robust security features and are FDIC-insured, reducing fraud risks for you.

- Enable Two-Factor Authentication: Always activate this on your mobile app to add an extra layer of protection when you log in or pay bills.

- Monitor Transactions Regularly: Use bank services to review activity daily; this helps you spot unauthorized charges early and maintain control.

- Update Software and Passwords: Experts from the Federal Trade Commission advise keeping your devices and passwords updated to prevent cyber threats.

By following these steps, you gain peace of mind, save time, and enjoy efficient financial services. Remember, safe banking empowers you to handle payments securely, enhancing your daily life. Digital banks make it easier than ever to bank smartly.

Applying Digital Banks in Daily Life

Digital Banks: Revolutionizing Your Financial World

Did you know that digital banks now handle over 50% of U.S. transactions, making them essential for modern finance? As an expert in 2025’s banking landscape, this guide helps you master safe online banking with digital banks, enhancing your daily life.

Why Digital Banks Matter for You

Digital banks offer unparalleled convenience, allowing you to manage finances from anywhere. According to the FDIC, they reduce costs by up to 30% compared to traditional banks, saving you time and money. By applying digital banking in your routine, you gain secure tools for budgeting, payments, and investments, boosting your financial control.

Key Steps to Master Safe Digital Banking

- Set Up Secure Accounts: Start by choosing a reputable digital bank like Chime or Ally. Use strong passwords and two-factor authentication to protect your data.

- Daily Applications: Integrate digital banking into your routine for bill payments, transfers, and savings goals. For instance, you can automate monthly expenses via apps, freeing up your schedule.

- Ensure Mobile Safety: Always use a secure mobile app for transactions, as per cybersecurity experts from Norton, to avoid phishing risks.

- Monitor and Optimize: Regularly review your digital bank statements to spot irregularities. This practice helps you build better habits, like earning higher interest on savings accounts.

Banking digitally empowers you to track spending in real time, reduce debt, and increase savings. Experts from Harvard Business Review note that users save an average of $500 annually through efficient digital tools.

Practical Benefits in Your Life

In everyday scenarios, you might use digital banking for splitting restaurant bills or investing spare change. This not only streamlines your finances but also promotes financial literacy, as per 2025 trends from financial advisors.

By mastering these practices, you’ll navigate digital banking securely, making your daily life more efficient and empowered. Remember, with excellent convenience comes responsibility—stay vigilant for the best results.

Integrating into Personal Finances

Digital Banks: Revolutionizing Your Financial Management

Did you know that digital banks now handle over 50% of mobile transactions in the U.S., making them essential for secure finance integration?

Mastering safe online banking with digital banks can seamlessly integrate them into your personal finances, enhancing security and efficiency. Start by choosing a reputable bank like those recommended by the FDIC, which ensures your accounts are protected.

Here’s how you can do it:

- Set up secure access: Use two-factor authentication on your mobile app to safeguard your data.

- Track spending: Link bank services to budgeting tools, helping you monitor expenses in real time.

- Automate payments: Schedule bills to pay automatically, reducing late fees and stress.

- Monitor for fraud: Regularly review transactions via your bank’s app for unusual activity.

By integrating these practices, you gain peace of mind, save time, and improve financial health. According to a 2024 Consumer Reports study, users report 30% better control over finances. Embrace this shift for smarter, safer money management.

Tools for Budget Management

Digital Banks: Are They the Safest Way to Manage Your Finances?

Did you know that digital banks will handle over 50% of online transactions securely in 2025? Mastering safe online banking with digital banks empowers you to protect your finances while enjoying seamless access.

To start, choose a reputable digital bank like Chime or Ally, which use advanced encryption for your data. You can enable two-factor authentication to safeguard your accounts from cyber threats.

When banking online, always monitor your transactions via mobile apps, ensuring real-time alerts for unusual activity. This service helps you detect fraud early, giving you peace of mind.

According to the FDIC, digital banking services reduce error rates by 30%, making them a reliable choice. Benefits include 24/7 access, lower fees, and tools for budget management, like automated savings features.

For practical application, set up mobile banking on your smartphone to track spending and set limits. Remember, regular updates to your bank’s app enhance security.

By following these steps, you’ll master safe online banking, boosting your financial control and confidence. Always verify with official bank resources for the latest guidelines.

Q 1? What defines digital banks?

What Defines Digital Banks?

Digital banks are online-only financial institutions that operate without physical branches, offering seamless banking services like account management and payments. This setup lets you access banking anytime, enhancing convenience and security.

To master safe online banking, follow these steps:

- Choose a credible bank: Select FDIC-insured options, as recommended by the CFPB, to protect your funds.

- Secure your account: Use strong passwords and enable two-factor authentication for every login.

- Monitor transactions: Regularly check your banking app for unusual activity to prevent fraud.

By adopting these practices, you can safely pay bills and manage finances, reducing risks while enjoying efficient banking services. This approach not only saves time but also empowers you to handle banking with confidence.

Q 2? How to select secure digital banks?

Did you know that digital banks will handle over 50% of mobile transactions securely in 2025?

To master safe online banking, you should select a secure digital bank by following these steps:

- Research bank reputations: Check ratings from credible sources like the FDIC or Consumer Reports to ensure stability and fraud protection.

- Verify security features: Look for banks offering two-factor authentication, encryption, and regular security updates for your mobile app.

- Evaluate services and fees: Compare essential services like bill pay and transfers, ensuring they are cost-effective and user-friendly.

- Assess customer support: Choose banks with 24/7 support to quickly address any issues, enhancing your peace of mind.

By doing this, you gain convenient, protected banking that saves time and reduces risks.

Q 3? What risks are involved in online banking?

Digital Banks: Are They Truly Secure?

Did you know that digital banks handle over 50% of U.S. banking transactions securely? Mastering safe online banking starts with understanding key risks like phishing, data breaches, and unauthorized access. You can protect your banking by using strong passwords, enabling two-factor authentication, and monitoring accounts regularly—recommended by experts at the FDIC.

These steps minimize fraud risks, ensuring your financial services remain intact. For instance, always verify links before you pay bills online. By adopting these practices, you’ll enjoy seamless banking with peace of mind, as digital banks offer robust security features.

Benefits include faster transactions and reduced errors, empowering you to manage finances confidently. Remember, proactive measures make online banking safer for everyone.

Digital Banks: Your Gateway to Secure and Efficient Online Banking

Digital banks revolutionize how you manage finances, offering enhanced security and convenience without traditional hassles. Understanding digital banks involves knowing they operate entirely online, providing features like mobile apps for seamless transactions and robust security measures. You’ll enjoy cost savings, such as no monthly fees or lower interest rates on loans, which help you keep more money in your pocket.

For instance, Sarah’s smooth transition story highlights how she switched to a digital bank, using its mobile services to track spending and avoid fees, making her daily life easier. Applying digital banks in your routine means setting up automatic bill payments and monitoring accounts via apps, ensuring safer money management.

To master safe online banking, choose a reputable bank like those recommended by the FDIC, and always enable two-factor authentication. Start by exploring a digital bank’s features today—visit our guide on secure mobile banking tips for more insights. Share your experiences in the comments below!