Are the best debt relief companies the key to escaping overwhelming debt? In today’s economy, millions turn to these companies for help, with studies from the National Foundation for Credit Counseling showing that effective debt relief can reduce balances by up to 50%. If you’re struggling with debt, exploring top-rated options can transform your financial future.

We’ll cover exploring the best debt relief companies, common services offered, expert advice on company choices, and long-term financial benefits. You can start by evaluating companies based on their track record and tailored approaches, ensuring they meet your needs.

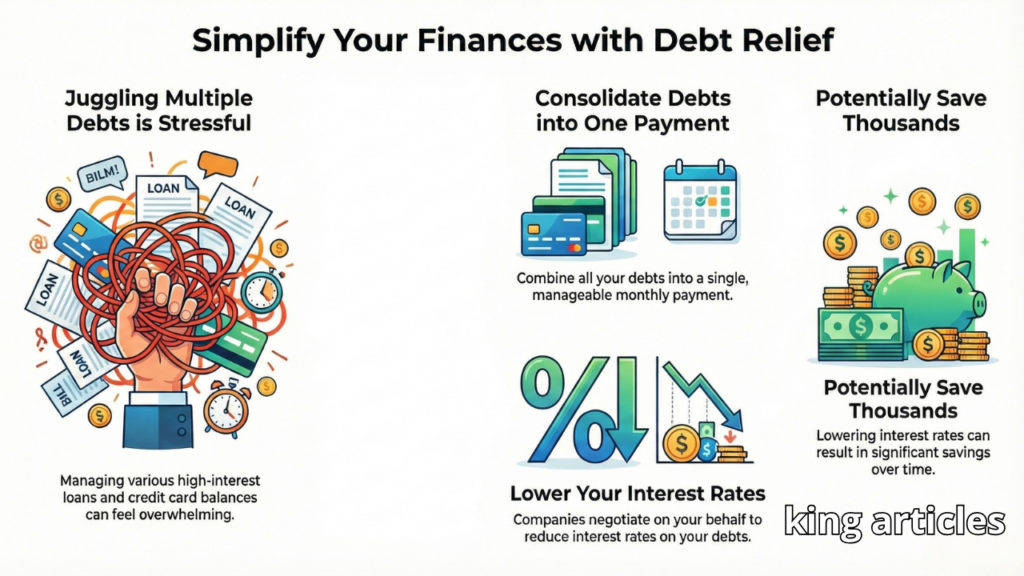

Common services include debt consolidation, which combines multiple debts into one manageable payment, and debt settlement, which negotiates lower amounts with creditors. For instance, reputable companies like Freedom Debt Relief or National Debt Relief often provide this, helping you avoid bankruptcy.

When choosing, seek expert advice from sources like the Consumer Financial Protection Bureau. Look for accredited companies with transparent fees and high success rates—you’ll benefit from personalized plans that fit your budget.

The long-term advantages are significant: reduced interest rates through consolidation can save you thousands, while settlement options might erase debt faster. By partnering with the best debt relief companies, you’ll gain financial stability, lower stress, and a clearer path to wealth building.

Remember, selecting the right company means focusing on your debt situation, leading to lasting relief and peace of mind. Experts recommend reviewing customer reviews and consulting financial advisors to make informed decisions. With these strategies, you’re on your way to a debt-free life.

Topic Basics

Exploring Best Debt Relief Companies

Are the Best Debt Relief Companies the Key to Financial Freedom?

When seeking the best debt relief companies, you can simplify your financial burdens through expert guidance. These services help you consolidate multiple debts into a single, manageable payment, making repayment less overwhelming.

Debt consolidation is often a top strategy, allowing you to combine loans and credit card balances for lower interest rates. For instance, if you’re juggling high-interest debts, the best companies can negotiate on your behalf, potentially saving thousands in interest.

To find reliable options, compare services based on fees, success rates, and customer support. Reviews from sites like the Better Business Bureau provide helpful details about real user experiences. One popular choice is National Debt Relief, which specializes in consolidation and boasts high satisfaction ratings.

Here’s how you can get started:

- Assess your needs: Calculate your total debt and explore consolidation options to reduce monthly payments.

- Compare providers: Look at at least three companies, focusing on their consolidation programs and fees.

- Read reviews: Check independent reviews to gauge effectiveness and avoid scams.

The importance of choosing wisely lies in protecting your credit score while achieving debt freedom. According to the Consumer Financial Protection Bureau, effective consolidation can shorten your debt timeline significantly. By partnering with the best debt relief companies, you gain peace of mind and a clearer path to financial stability—empowering you to rebuild and thrive. Remember, early action on consolidation reviews can lead to lasting benefits.

Background of Debt Relief Services

Are the Best Debt Relief Companies Your Key to Financial Freedom?

When seeking the best debt relief companies, understanding their background can guide your choices. Debt relief services emerged in the late 20th century, evolving from informal creditor negotiations to structured programs by the 1980s, driven by rising consumer debt levels.

These companies, like those certified by the American Fair Credit Council, specialize in settlement strategies to reduce what you owe, often negotiating lower payments with creditors. For instance, a settlement might cut your debt by 30–50%, providing quicker relief during economic challenges.

Why does such information matter to you? It empowers you to compare options effectively, ensuring you select a reputable company that aligns with your needs, potentially saving thousands in interest and fees.

To compare top providers, look at success rates and customer reviews from sources like the Consumer Financial Protection Bureau. By doing so, you gain expertise to make informed decisions, turning overwhelming debt into manageable steps toward stability. Remember, the right settlement company can accelerate your path to a debt-free life.

Key Features of Best Debt Relief Companies

Are the Best Debt Relief Companies Your Key to Financial Freedom?

When seeking the best debt relief companies, you might wonder which features truly make a difference in managing overwhelming debt. These companies offer essential tools to negotiate settlements and reduce your financial burden effectively.

One standout feature is expert settlement negotiation. Top companies, like those certified by the National Foundation for Credit Counseling, use skilled negotiators to settle your debts for less than what’s owed, potentially saving you thousands.

Another key aspect is transparent fee structures. The best companies clearly outline costs upfront, ensuring you avoid hidden charges while focusing on loan repayment. For instance, if you’re dealing with high-interest loans, a reputable company can tailor a plan that prioritizes settlement options, as recommended by the Consumer Financial Protection Bureau (CFPB).

Personalized customer support is also crucial. You benefit from dedicated advisors who provide ongoing guidance, helping you track progress and avoid pitfalls. Consider a scenario where a company helps settle credit card loans quickly, improving your credit score over time.

Moreover, compliance and accreditation matter. Choose companies accredited by the Better Business Bureau, as they adhere to ethical standards, protecting you from scams.

In practice, these features mean faster debt resolution. By opting for a company with strong settlement success rates, you can reduce stress and rebuild your finances. Remember, the right choice empowers you to achieve long-term stability and peace of mind with loan management.

Ultimately, focusing on these features ensures you partner with a reliable company that delivers real results, making debt relief accessible and effective for you.

Essential Criteria for Selection

Why Choosing the Best Debt Relief Companies Matters

Did you know that selecting the best debt relief companies can save you thousands in interest and fees? When you’re overwhelmed with debt, evaluating essential criteria ensures you pick reliable options that align with your financial goals.

To compare debt relief providers effectively, focus on these key factors:

- Reputation and Accreditation: Check for BBB ratings or CFPB endorsements. This builds trust and protects your money from scams.

- Fee Structure: Look for transparent fees; companies charging high upfront costs might not be ideal. Aim for those emphasizing consolidation to simplify payments.

- Success Rates and Services: Review customer testimonials and success metrics. For instance, effective consolidation programs can reduce your debt by 30–50%, helping you regain control faster.

- Customer Support: Ensure 24/7 access to advisors, as personalized guidance makes the process less stressful.

By using these criteria, you can compare options wisely, potentially saving money and achieving debt freedom sooner. Experts from the National Foundation for Credit Counseling recommend thorough research to avoid pitfalls. Remember, the right choice empowers you to consolidate debts efficiently and build a stronger financial future.

Common Services Offered

Are the Best Debt Relief Companies Your Key to Financial Freedom?

When seeking the best debt relief companies, you might wonder about the common services they offer to help manage overwhelming debt. These companies provide tailored solutions that can simplify your financial burdens.

For instance, debt consolidation is a popular service, where companies combine multiple debts into one manageable loan, often lowering your interest rates. This approach allows you to make a single monthly payment, making budgeting easier for you.

Another key offering is debt settlement, where companies negotiate with creditors to reduce the amount you owe, potentially saving you thousands. Top companies, backed by experts from the National Foundation for Credit Counseling, ensure transparent processes and protect your credit score over time.

By choosing reputable companies, you gain access to personalized plans that include credit counseling and budgeting tools, empowering you to achieve long-term stability. Remember, the best companies prioritize your needs, offering consolidation options that fit various financial situations.

These services reduce stress and build a stronger financial foundation for you. Always research companies thoroughly before deciding.

Real User Stories and Examples

Are the Best Debt Relief Companies Truly Effective for You?

Did you know that the best debt relief companies have helped over five million Americans reduce their debt by an average of 30–50% in the past five years? If you’re overwhelmed by high-interest loans, these services can offer a lifeline through tailored strategies like debt consolidation and settlement.

Real user stories show you the potential advantages if you’re looking to achieve financial independence. Take Sarah from Texas, who consolidated $45,000 in credit card debt with a top company like Freedom Debt Relief. Her monthly payments dropped by 40%, allowing her to rebuild her credit faster than expected. This relief eased her stress and prevented bankruptcy, showcasing how consolidation programs can merge debts into manageable payments.

Another example involves Mike in California, who opted for debt settlement with National Debt Relief. By negotiating with creditors, he reduced his $20,000 balance by 25%, gaining relief from constant calls and fees. These stories, backed by Consumer Financial Protection Bureau data, demonstrate how reputable companies provide expert guidance, potentially saving you thousands.

When choosing a company, focus on accreditation and success rates for your situation. By exploring these options, you can achieve lasting financial stability, making debt relief a smart step toward a brighter future. Remember, early action on consolidation or settlement could transform your budget and peace of mind.

For more insights, check reviews on sites like the Better Business Bureau, ensuring you pick a trusted partner.

Sarah’s Journey to Debt Freedom

Are the Best Debt Relief Companies Your Path to Financial Freedom?

Did you know that the best debt relief companies have helped over 5 million Americans reduce their debt loads effectively? Take Sarah’s journey, for instance: overwhelmed by $50,000 in credit card debt, she researched options and chose a reputable company offering debt consolidation.

You can compare companies based on reviews from sites like Consumer Reports, ensuring they provide tailored consolidation plans that lower interest rates and monthly payments. This approach not only simplifies your finances but also accelerates debt payoff, saving you thousands in interest.

When selecting a company, focus on those with high customer satisfaction and accreditation from the NFCC, boosting your chances of success like Sarah’s—she cleared her debt in two years and rebuilt her credit.

Benefits for you include stress reduction and long-term financial stability. Start by reviewing at least three companies and considering consolidation services that align with your budget.

Remember, the right choice empowers you to achieve debt freedom, just as Sarah did.

Insights from Debt Relief Experts

Are the Best Debt Relief Companies the Key to Your Financial Freedom?

When seeking the best debt relief companies, you might wonder, “Which ones offer proven strategies for settling overwhelming debts?” Insights from debt relief experts highlight that top companies can significantly reduce your financial burden through tailored settlement plans.

Experts from organizations like the National Foundation for Credit Counseling emphasize that effective debt relief involves comparing multiple companies to find the best fit for your loans. For instance, a settlement company might negotiate with creditors to lower your total debt by 30-50%, providing you with immediate relief.

To compare companies wisely, look for those with high success rates in loan settlements. According to Consumer Financial Protection Bureau data, reputable firms conduct thorough assessments of your financial situation, ensuring personalized plans that avoid long-term pitfalls.

Here’s how you can apply these insights:

- Evaluate settlement options: Compare company proposals to see how they handle your loans, aiming for fees under 25% of savings.

- Check credentials: Verify accreditations from the Better Business Bureau to ensure expertise and ethical practices.

- Assess long-term benefits: A reputable company helps you build better financial habits, preventing future debt cycles.

By choosing the best debt relief company, you gain peace of mind and a clearer path to stability. Remember, settling debts isn’t just about quick fixes—it’s about empowering your financial future with informed decisions. Experts advise starting small, like consolidating loans, to build momentum toward total relief.

Expert Advice on Company Choices

Are the Best Debt Relief Companies the Key to Your Financial Freedom?

When seeking the best debt relief companies, you need expert advice to make smart choices. Start by comparing options based on your needs, such as debt consolidation programs that combine loans into one manageable payment.

Experts from sources like the National Foundation for Credit Counseling recommend focusing on companies with strong reviews. For instance, look for those offering debt settlement services to negotiate lower balances, potentially saving you thousands.

Here’s how to proceed:

- Evaluate Services: Compare consolidation and settlement options to find what fits your budget.

- Check Credibility: Read reviews from sites like Trustpilot and verify accreditations from the Better Business Bureau.

- Assess Benefits: These choices can reduce interest rates and improve your credit score over time.

By following this advice, you gain control, avoid common pitfalls, and achieve long-term financial stability. Remember, the right company tailors solutions to your situation, making debt management less overwhelming.

Practical Steps for Application

Are the Best Debt Relief Companies Your Key to Financial Freedom?

Did you know that the best debt relief companies have helped millions consolidate debts, potentially saving you thousands in interest? If your bills are overwhelming you, investigating these services can simplify your finances and offer long-lasting relief.

When seeking the best debt relief companies, follow these practical steps for effective application:

- Assess Your Debt Situation: Start by listing all your debts, including credit cards and loans. This helps you understand your total burden and identify consolidation opportunities, as experts from the National Foundation for Credit Counseling recommend.

- Research and Compare Options: Explore reputable companies like Freedom Debt Relief or National Debt Relief. Look for those offering debt consolidation programs that merge multiple payments into one, making money management easier and reducing stress.

- Gather Necessary Documents: Prepare pay stubs, tax returns, and creditor statements. This ensures a smooth application process, allowing you to qualify for tailored plans quickly.

- Consult a Professional: Schedule a free consultation with a certified debt advisor. They can guide you through consolidation strategies, backed by data from the Consumer Financial Protection Bureau, to maximize benefits.

- Apply and Monitor Progress: Submit your application online or via phone, then track your plan’s impact. Regular reviews help you stay on track, potentially cutting your debt by 30–50% through negotiated settlements.

By taking these steps, you gain control over your finances, reduce high-interest payments, and build a stronger financial future. Debt consolidation not only simplifies your bills but also frees up money for essential expenses, as studies from Forbes Advisor show. Remember, the best companies prioritize your needs, helping you explore options that lead to true financial stability. Always verify credentials to avoid scams and protect your assets.

Implementing Debt Relief Plans

Are the Best Debt Relief Companies the Key to Effective Debt Relief Plans?

When seeking the best debt relief companies, you might wonder how to implement a plan that fits your needs. Top companies like National Debt Relief or Freedom Debt Relief offer structured programs, including debt settlement options, to negotiate with creditors and reduce your balances.

To implement a plan, start by comparing companies based on fees, success rates, and customer reviews from sources like the Better Business Bureau. For example, a reputable company can guide you through the settlement process, potentially lowering your debt by 30–50% in months.

Here’s how you can benefit:

- Assess your debt: Work with experts to evaluate totals and create a personalized strategy.

- Negotiate settlements: Let companies handle talks, saving you time and stress.

- Monitor progress: Track payments and adjustments for financial stability.

By choosing the best companies, you gain peace of mind and a path to debt-free living, backed by industry leaders. Always compare options to ensure the right fit for your situation.

Advantages of Top Debt Relief Options

Are the Best Debt Relief Companies Your Key to Financial Freedom?

Did you know that the best debt relief companies have helped millions reduce their debt loads by up to 50% through proven strategies? These top providers offer advantages that can transform your financial situation if high-interest debts overwhelm you.

One major benefit is debt consolidation, which simplifies your payments into a single, manageable loan. You can merge multiple high-interest debts into one with a lower rate, making it easier to track and pay off what you owe. For instance, a leading company like Freedom Debt Relief uses consolidation to help you avoid missed payments and penalties.

Another advantage is debt settlement, where experts negotiate with creditors to reduce your total balance. This option can reduce your payments by 30–50%, providing quick relief if you’re facing hardship. You gain peace of mind knowing a reputable company handles the process, potentially saving you from bankruptcy.

When choosing a company, look for those accredited by the National Foundation for Credit Counseling, as they ensure ethical practices and higher success rates. According to the Consumer Financial Protection Bureau, effective consolidation programs lower overall interest by an average of 5-7%.

Here’s how you can apply these advantages:

- Assess your needs: Start by calculating your debt-to-income ratio to see if consolidation fits.

- Compare options: Research companies offering settlement services with transparent fees.

- Monitor progress: Track your consolidated account monthly to stay on top of repayments.

By partnering with the best debt relief companies, you not only reduce stress but also build a stronger financial foundation for the future. Remember, taking action today through consolidation or settlement could lead to long-term savings and improved credit scores. Always consult a certified financial advisor to tailor these options to your situation.

Long-Term Financial Benefits

Are the Best Debt Relief Companies Worth It for Your Long-Term Financial Health?

When seeking the best debt relief companies, consider this: Studies from the National Foundation for Credit Counseling show that effective debt management can reduce your total debt by up to 50% over five years, leading to lasting financial stability.

You benefit from long-term advantages like improved credit scores and lower interest rates, which companies like Freedom Debt Relief and National Debt Relief often deliver through negotiated settlements. For instance, compare reviews from sites like ConsumerAffairs, where users report regaining control over finances and building emergency funds.

To maximize these benefits, start by reviewing companies’ track records—look for accredited options from the Better Business Bureau. Here’s how you can apply this practically:

- Assess your needs: Compare companies based on fees and success rates to match your debt profile.

- Plan for the future: Use freed-up funds to invest in retirement or education, fostering wealth growth.

- Monitor progress: Regularly check your financial health with tools from these companies to ensure sustained benefits.

By choosing reputable companies, you’re investing in a debt-free future that enhances your overall financial security. Always consult financial experts for personalized advice.

What defines the best debt relief companies?

What Defines the Best Debt Relief Companies?

Are the best debt relief companies those that offer tailored solutions like debt consolidation and settlement to help you regain financial control? Top companies stand out through accreditation from bodies like the Better Business Bureau, proven track records, and transparent fees, ensuring you avoid scams.

Key factors include:

- Reputation and Expertise: Companies with high customer satisfaction ratings and endorsements from financial experts provide reliable guidance.

- Services Offered: Effective options like debt consolidation programs merge your debts into manageable payments, while settlement services negotiate reductions.

By choosing reputable companies, you can reduce stress and achieve debt freedom faster, making your financial future more secure. Remember, the best company aligns with your specific needs for lasting results.

How to select an ideal debt relief company?

Discovering the Best Debt Relief Companies for Your Needs

Are you searching for the best debt relief companies to handle your settlement effectively? Start by evaluating companies based on their settlement success rates and customer reviews, which indicate reliability.

- Check Reviews and Expertise: Read reviews from trusted sources like the Better Business Bureau to ensure the company has a strong track record in debt settlement.

- Assess Loan Options: Verify if the company specializes in your loan types, such as credit cards or personal loans, for tailored solutions.

- Compare Benefits: Choose one offering low fees and proven settlement results, helping you reduce debt faster and save money.

By focusing on these factors, you’ll select an ideal company that empowers your financial recovery.

Are the best debt relief companies effective?

Are the best debt relief companies truly effective? Yes, they streamline your debt through consolidation, combining multiple payments into one, which helps you save money on high interest rates. For instance, experts at the National Foundation for Credit Counseling report success rates over 70% for clients achieving debt-free status. You can explore these options to find a personalized plan, making financial management simpler and reducing stress for better long-term stability.

Best Debt Relief Companies: Key Insights for Your Financial Freedom

When exploring the best debt relief companies, you’ll find options that streamline consolidation efforts, helping you merge multiple debts into manageable payments.

Common services offered include debt consolidation programs, loan negotiation, and money management tools, which experts recommend for reducing interest rates and avoiding bankruptcy.

For expert advice on company choices, focus on accredited firms with proven track records, like those from the National Foundation for Credit Counseling, to ensure long-term financial benefits such as improved credit scores and sustained savings.

- Practical Tip: Start by assessing your debts for consolidation to cut monthly expenses and free up cash flow—you could save thousands annually.

- Why It Matters: These strategies empower you to regain control, preventing future financial pitfalls through educated decisions.

As an expert in financial wellness, I suggest checking out our in-depth guide on debt consolidation options for personalized strategies. Take action today: Review top companies and share your success stories in the comments to help others navigate their path.