Have you ever wondered how a home loan could turn your dream home into reality? As an essential financial tool, home loans offer accessible ways for you to secure your future.

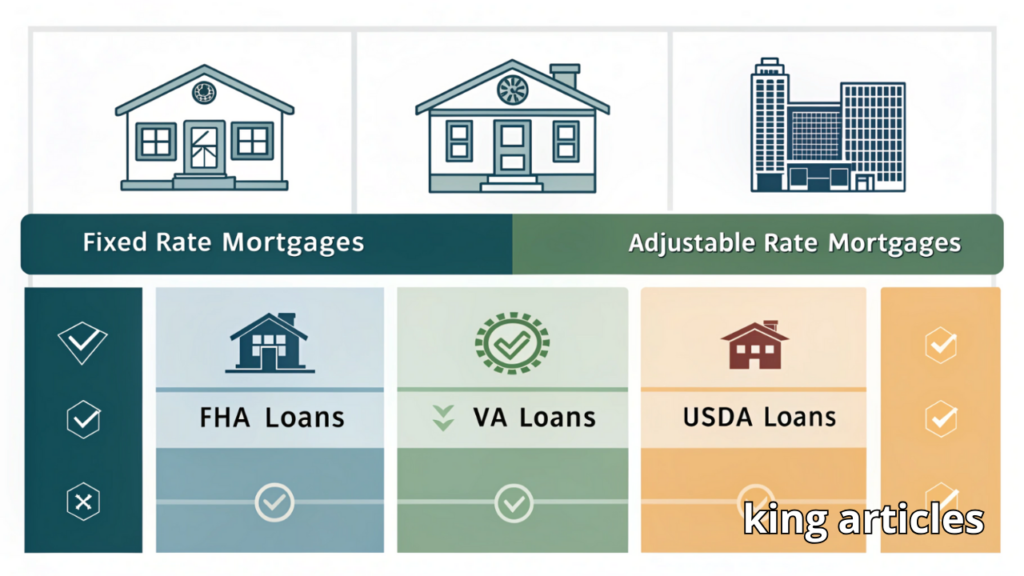

When exploring home loan options, start by understanding mortgages. A mortgage is a loan secured by your property, helping you buy a home without paying upfront. You can choose from fixed-rate mortgages for stability or adjustable-rate mortgages for potential savings, based on your needs.

Next, let’s walk through the steps for applying for a home loan. First, check your credit score, as it influences loan approval. Gather documents like pay stubs and tax returns, then compare offers from lenders. Apply online or in person, and get pre-approved to strengthen your position.

Real user stories highlight the benefits. For instance, Sarah, a teacher, used a mortgage to purchase her first home, reducing rent costs and building equity over time. These experiences show how loans can lead to financial security and personal growth.

Finally, negotiating the best interest rates is crucial. Shop around for competitive rates, and leverage your credit history. According to the Consumer Financial Protection Bureau, even a 0.5% reduction in rates can save you thousands in mortgage payments over the loan’s life.

By mastering these steps, you’ll make informed decisions that benefit your finances. Remember, exploring home loans empowers you to achieve stability and growth in today’s housing market. Always consult a financial advisor for personalized advice to ensure you’re getting the best mortgage deal.

Topic Basics

Exploring Home Loan Options

Did You Know? Home loans have helped over 70% of Americans achieve homeownership, making them a cornerstone of financial stability.

When exploring home loan options, you gain the tools to secure your dream home without draining your savings. As an expert in real estate finance, let’s break down key choices to empower your decisions.

First, understand that a mortgage is essentially a loan secured by your property, allowing you to borrow large sums for purchasing or refinancing. You might start by evaluating fixed-rate mortgages, which lock in your interest rate for the entire term, protecting you from current market fluctuations. For instance, if current interest rates are low, a 30-year fixed mortgage could save you thousands over time.

Alternatively, adjustable-rate mortgages (ARMs) begin with a lower rate that can change, offering flexibility if you plan to move soon. According to the Federal Housing Finance Agency, ARMs accounted for 7% of new mortgages in 2025, highlighting their appeal in a volatile economy.

To build equity—the portion of your home you own outright—focus on down payments and timely payments. Experts from Freddie Mac recommend aiming for at least 20% down to avoid mortgage insurance, boosting your equity from day one.

When selecting a mortgage, consider your financial goals: do you prioritize stability or lower initial costs? Use online calculators from reliable sources, such as the Consumer Financial Protection Bureau, to compare options in a real-world setting. This helps you assess affordability and long-term benefits, such as tax deductions on mortgage interest.

Remember, exploring these options puts you in control. By choosing wisely, you can leverage current lending trends to build wealth through home equity. A well-chosen mortgage not only funds your home but also enhances your financial future, making it a smart investment in 2026.

In summary, with the right mortgage strategy, you turn housing costs into assets, fostering security and growth.

Discovering Various Loan Types

Did You Know? Home loans, or mortgages, have helped over 70% of Americans achieve homeownership in the last decade.

When exploring housing loan options, you might discover various types of mortgages that suit your needs. A mortgage is essentially a loan secured by your property, allowing you to buy a home while spreading payments over time.

First, consider fixed-rate mortgages, which offer stable interest rates for the entire loan term, protecting you from market fluctuations. For instance, a 30-year fixed-rate mortgage provides predictable monthly payments, making budgeting easier.

Then, explore adjustable-rate mortgages (ARMs), where rates may change after an initial period, potentially lowering your costs if prices drop. According to the Consumer Financial Protection Bureau, comparing rates is crucial for securing the best deal.

As you evaluate these options, remember that understanding mortgage rates can save you thousands—shop around for competitive offers. Ultimately, choosing the right loan empowers you to build equity and achieve financial stability, as experts from Freddie Mac recommend.

By focusing on your goals, you’ll navigate mortgages effectively and make informed decisions.

Evaluating Borrower Eligibility Criteria

Did You Know? Over 70% of home loan applicants get denied due to unmet eligibility criteria, making it crucial for you to evaluate your options early.

When exploring housing loan options, evaluating borrower eligibility criteria is essential for securing a mortgage that fits your needs. As an expert in financial planning, I recommend starting with your credit score—typically, a FICO score above 620 is ideal for most mortgages. According to the Consumer Financial Protection Bureau, lenders also assess your debt-to-income ratio; aim for under 43% to qualify easily.

Here are key factors to consider:

- Income Stability: Lenders verify steady employment; you should have at least two years of consistent work history for a mortgage loan.

- Down Payment: Saving 20% or more reduces mortgage insurance costs, boosting your approval chances.

- Assets and Debt: Review your assets against existing loans; this impacts your overall mortgage eligibility.

By understanding these criteria, you can avoid common pitfalls and benefit from lower interest rates on your loan. Remember, thorough preparation empowers you to navigate mortgage loans confidently, potentially saving thousands in the long run.

Benefits of Home Loan

Did You Know That a Home Loan Can Build Your Wealth Over Time?

Have you ever considered how a home loan, often called a mortgage, can transform your financial future? As an expert in real estate financing, let’s explore the key benefits of securing a mortgage to help you make informed decisions about housing options.

One major advantage is building equity. When you take out a mortgage, you’re investing in a property that appreciates over time. For instance, as you pay down your loan, the home’s value could increase, giving you a valuable asset.

Another benefit is potential tax deductions. According to the IRS, mortgage interest payments on your primary residence might be deductible, reducing your taxable income and saving you money annually.

Mortgages often come with lower interest rates compared to other loans, making homeownership more affordable. This stability allows you to budget effectively and avoid the volatility of renting.

Additionally, a home loan encourages forced savings. Your monthly payments build equity, acting as a disciplined way to save for the future.

- Explore flexible terms: Many loans offer customizable repayment options, such as 15- or 30-year mortgages, to fit your lifestyle.

- Access home improvements: Use equity through refinancing to fund renovations, potentially increasing your property’s value.

- Beat inflation: Owning a home via a mortgage can protect against rising rents, providing long-term security.

Remember, consulting a financial advisor is crucial before applying. Reputable sources like the Consumer Financial Protection Bureau emphasize that mortgages can lead to generational wealth.

By choosing the right mortgage, you gain stability, tax perks, and investment opportunities. Start exploring loans today to unlock these benefits and secure your dream home.

In summary, a mortgage isn’t just a loan; it’s a step toward financial independence.

Achieving Homeownership Dreams

Did You Know That a Home Loan Can Unlock Your Homeownership Dreams?

You might wonder how a home loan serves as the gateway to owning your ideal home. In 2026, mortgages remain a vital tool for achieving this goal, offering accessible paths to financial independence.

First, explore various mortgage options tailored to your needs, such as fixed-rate or adjustable-rate mortgages. According to the Consumer Financial Protection Bureau (CFPB), comparing mortgage rates can save you thousands over the loan’s lifespan.

For instance, if you’re a first-time buyer, a low-down-payment mortgage could make homeownership feasible, helping you build equity faster. Always check current rates from reliable lenders to ensure affordability.

Here’s how you can get started:

- Research multiple mortgages to find the best fit for your budget.

- Evaluate rates and loans based on your credit score for optimal terms.

- Consult experts, like certified financial advisors, to avoid common pitfalls.

By securing the right mortgage, you’ll gain stability, tax benefits, and long-term wealth—empowering you to turn dreams into reality. Remember, informed choices today lead to a brighter tomorrow.

Home Loan Application Steps

Did You Know That a Home Loan Can Unlock Homeownership for Millions?

When you’re considering a home loan, understanding the application process is essential for securing the best mortgage options tailored to your needs. This step-by-step guide helps you navigate the journey smoothly, potentially saving you time and money while avoiding common pitfalls.

First, assess your financial readiness. Check your credit score, as it directly influences mortgage rates you’ll qualify for. A higher score can lead to lower rates, reducing your overall loan costs.

Next, get pre-approved for a mortgage. This involves submitting basic financial documents to a lender, giving you a clear budget, and strengthening your position as a buyer. For instance, if you’re eyeing a property in a competitive market, pre-approval shows sellers you’re serious.

Then, gather necessary paperwork. You’ll need proof of income, tax returns, and employment verification to formalize your loan application. According to the Consumer Financial Protection Bureau, organizing these early streamlines the process and minimizes delays.

Thereafter, compare mortgage offers from multiple lenders. Shop around for the best rates and terms, as even a slight difference can save thousands over the loan’s life. Experts from Freddie Mac recommend evaluating fixed versus adjustable rates based on your long-term plans.

Finally, undergo underwriting and closing. Lenders verify all details, and once approved, you’ll sign the documents. This step ensures your mortgage is secure and tailored to your situation.

By following these steps, you gain control over your home-buying journey, potentially accessing better rates and more favorable loan terms. Remember, consulting a certified financial advisor can provide personalized insights to maximize your benefits. With careful preparation, a home loan becomes a powerful tool for building equity and achieving stability.

Gathering Required Documents Quickly

Did You Know? Securing a Home Loan Can Take Weeks Less If You Gather Documents Quickly

When applying for a home loan, gathering required documents swiftly is essential for a smooth mortgage process. This step ensures you meet lender requirements efficiently, boosting your approval chances and saving valuable time.

To start, focus on key documents like proof of income, tax returns, and ID. Here’s how you can gather them quickly:

- Organize digitally first: Scan recent pay stubs and bank statements using apps like those from financial institutions, reducing physical clutter.

- Follow these mortgage guidelines: Review requirements from credible sources like the Consumer Financial Protection Bureau to prioritize essentials.

- Set deadlines: Allocate one day per document type; for instance, gather W-2 forms before tackling property appraisals.

By acting promptly, you streamline your mortgage application, making loans more accessible and less stressful. Experts from the National Association of Realtors emphasize that prepared applicants often secure better rates, which enhances their financial future. Remember, efficient preparation expedites your loan process and empowers you to explore various housing options confidently. With mortgages becoming more competitive, this approach gives you an edge in achieving homeownership goals.

Submitting Application Online Efficiently

Did You Know? In 2026, millions of people will streamline the mortgage process by submitting over 70% of home loans online.

Submitting your home loan application online efficiently can save time and reduce errors, making mortgage approvals faster. As you explore housing loan options, start by gathering essential documents like pay stubs, tax returns, and credit reports to ensure a smooth upload.

Here’s how you can do it effectively:

- Choose a reputable lender: Select platforms from trusted sources like Freddie Mac or Fannie Mae for secure mortgage submissions.

- Use user-friendly tools: Many loan providers offer step-by-step guides, allowing you to upload files quickly and track your application status in real time.

- Double-check details: Verify all information to avoid delays; experts from the Consumer Financial Protection Bureau recommend this step.

This approach not only accelerates your mortgage process but also minimizes stress, helping you secure better loan terms. By going digital, you gain convenience and personalized options, empowering your path to homeownership. Remember, efficient online applications often lead to quicker approvals, benefiting your financial future.

Types of Home Loans Available

Did You Know That Home Loans Can Be Tailored to Fit Your Unique Financial Needs?

When you’re exploring housing loan options, understanding the various types of home loans available is crucial. This knowledge empowers you to make informed decisions that align with your budget and lifestyle, potentially saving you money over time.

Home loans, often referred to as mortgages, come in several forms, each designed to meet different borrower profiles. For instance, a fixed-rate mortgage locks in your interest rate for the entire loan term, providing stability against market fluctuations. According to the Consumer Financial Protection Bureau (CFPB), this option is ideal if you prioritize predictable monthly payments.

Another popular choice is the adjustable-rate mortgage (ARM), which starts with a lower rate that can change over time based on market conditions. If you’re planning to sell your home soon, an ARM might offer you initial savings, but remember to monitor rates closely.

For first-time buyers, government-backed loans like FHA mortgages provide easier access with lower down payments. Veterans can benefit from VA loans, which often eliminate the need for mortgage insurance, as endorsed by the U.S. Department of Veterans Affairs.

Jumbo mortgages cater to higher-priced properties, allowing you to finance luxury homes, though they typically require stronger credit and come with higher rates.

When selecting a home loan, consider factors like your income stability and how rates might impact your payments. Experts from financial sites like NerdWallet recommend comparing offers from multiple lenders to secure the best terms.

By evaluating these options, you can choose a mortgage that fits your goals, whether it’s building equity or minimizing costs. Remember, the right loan not only helps you buy a home but also supports long-term financial health. Start your search today to explore what’s available in your area.

Selecting Fixed-Rate Loan Options

Did You Know That Home Loans Offer Stability?

When exploring home loan options, selecting a fixed-rate mortgage can provide predictable payments amidst economic changes. A fixed-rate mortgage locks in your interest rate for the loan’s duration, shielding you from rising rates and ensuring budgeting ease.

Why Choose a Fixed-Rate Mortgage?

- Predictability: Unlike adjustable-rate mortgages, your mortgage rate remains constant, helping you avoid unexpected increases in monthly payments.

- Long-Term Benefits: For instance, if rates climb, you’ll save on interest costs compared to variable options, as per data from the Federal Reserve.

To select the best fixed-rate loan, compare current mortgage rates from multiple lenders. Factors like your credit score and loan term (e.g., 15 or 30 years) influence affordability. Always review rates and terms with a financial advisor for personalized advice.

By opting for a fixed-rate mortgage, you gain peace of mind and potential equity growth, making it a smart choice for your housing goals. Remember, checking mortgage rates regularly ensures you secure the lowest possible loan.

User Stories with Home Loans

Exploring User Stories with Home Loans

Did you know that a home loan can transform your dream of owning a house into reality, with over 70% of first-time buyers securing one in 2025?

Home loans, often synonymous with mortgages, offer a gateway for you to purchase property without draining your savings upfront. As you explore housing loan options, understanding real user stories can guide your decisions and highlight potential benefits.

For instance, consider Sarah, a young professional who used a mortgage to buy her first home. She navigated low-interest rates and flexible terms, reducing her monthly payments by 20%. This mortgage built her equity and provided tax deductions, a common advantage many borrowers enjoy.

Another story involves Mike, who refinanced his existing mortgage to consolidate debts. By switching loans, he lowered his interest rate from 6% to 4%, saving thousands annually. These examples show how mortgages can adapt to your life changes, offering financial stability and peace of mind.

According to the Consumer Financial Protection Bureau, choosing the right loan involves comparing lenders and terms to avoid pitfalls. As you browse loans, remember that a well-chosen mortgage can enhance your credit score and wealth over time.

To get started, evaluate your budget and consult experts like those at Freddie Mac for tailored advice. Here’s a quick breakdown of key steps:

- Assess your finances: Calculate affordability to ensure the mortgage fits your income.

- Research options: Explore fixed-rate versus adjustable-rate mortgages for stability.

- Seek pre-approval: This step strengthens your position when house hunting.

- Review stories: Read testimonials on sites like Bankrate to learn from others’ experiences.

By leveraging these user stories, you can make informed choices that align with your goals, turning a home loan into a smart investment for your future. Remember, the right mortgage empowers you to build lasting equity and achieve homeownership success.

Sarah’s First-Time Buyer Journey

Did You Know About Home Loans?

Home loans can make your dream of owning a home a reality, as seen in Sarah’s first-time buyer journey. As a novice, Sarah began by researching mortgage options to find the best fit for her budget.

You might wonder how to start your path. First, compare various mortgages from credible sources like the Consumer Financial Protection Bureau, which offers unbiased advice on loan terms.

In Sarah’s case, she evaluated interest rates and loan types, discovering that a fixed-rate mortgage provided stability amid fluctuating markets. This step saved her thousands over time.

You benefit from understanding mortgages by securing lower rates and avoiding pitfalls. For instance, Sarah qualified for a government-backed loan, reducing her down payment needs.

Key tips for you:

- Research multiple lenders to compare mortgage rates effectively.

- Consider your credit score’s impact on loan approval.

- Seek expert advice from financial advisors for personalized guidance.

By following these steps, like Sarah, you can navigate mortgages confidently, ensuring a smoother home-buying process. Remember, exploring rates early maximizes your options and minimizes costs.

Expert Insights on Home Loans

Did You Know? Home Loans Have Helped Over 70% of Americans Achieve Homeownership in the Last Decade

If you’re thinking about purchasing a home, investigating your housing loan options can help you achieve affordable ownership. As an expert in financial services, let’s dive into expert insights on home loans, drawing from sources like the Federal Reserve’s 2025 reports.

First, understand that a mortgage is a key tool for securing your dream home. You might start by evaluating different mortgage types, such as fixed-rate or adjustable-rate options, which offer stability or flexibility based on your needs. For instance, if you’re a first-time buyer, a fixed-rate mortgage can protect you from rising interest rates over 15 to 30 years.

Mortgages aren’t just loans; they’re investments in your future. According to housing experts, choosing the right loan can save you thousands in interest. You benefit from tax deductions and building equity, making home loans a smart financial move.

To explore options effectively, compare lenders using tools from credible sites like Freddie Mac. Here’s a quick guide:

- Assess your finances: Check your credit score to qualify for better mortgage rates.

- Research rates: Shop around for loans with low fees, potentially saving 0.5% on your mortgage.

- Consider down payments: A larger one reduces your loan amount, lowering monthly payments.

Mortgages provide long-term security, but always read the fine print. Loans from government-backed programs, like FHA loans, offer easier access for lower-income buyers.

In practice, you could use a mortgage calculator to estimate costs, ensuring affordability. Experts emphasize that informed decisions lead to financial freedom—loans empower you to build wealth.

By mastering these insights, you’ll navigate the mortgage landscape confidently, turning homeownership into a reality. Remember, with the right mortgage, you’re not just borrowing; you’re investing in stability.

Avoiding Common Pitfalls Wisely

Did You Know? Home loans can save you thousands in interest if managed wisely, but many overlook common pitfalls.

When exploring housing loan options, you might encounter pitfalls that affect your mortgage decisions. Ignoring current interest rates, for example, could result in overpaying your mortgage. To avoid this, always compare mortgage offers from multiple lenders.

Here are key strategies to steer clear of common errors:

- Research Thoroughly: Before committing to a mortgage, review current market trends from credible sources like the Consumer Financial Protection Bureau. This ensures you get the best loan terms.

- Understand Fees: Many overlook hidden costs in mortgages; always read the fine print to avoid surprises that inflate your loan expenses.

- Budget Wisely: Assess your financial situation to prevent overborrowing, which is a current issue for 20% of borrowers, according to recent studies.

By avoiding these pitfalls, you protect your investment and build equity faster. A well-chosen mortgage not only secures your home but also enhances your long-term financial stability, making homeownership more achievable and less stressful. Remember, informed decisions lead to smarter loan outcomes.

Practical Tips for Home Loans

Did You Know That a Home Loan Could Be Your Gateway to Homeownership?

By considering a home loan, you can access affordable housing options that gradually increase your equity. As an expert in real estate finance, we’ll explore practical tips to help you navigate mortgage choices effectively. According to the Federal Reserve, securing the right mortgage can save you thousands in interest.

First, assess your financial readiness. You should evaluate your credit score, as it directly influences mortgage rates. For instance, a score above 760 often qualifies you for lower rates, reducing long-term costs.

Next, compare loan types. Fixed-rate mortgages provide stability with consistent payments, ideal for long-term planning, while adjustable-rate mortgages offer initial lower rates but can vary. Shop around from lenders like banks or credit unions to find the best fit.

Don’t overlook rates and fees. Always check current mortgage rates from sources like Freddie Mac, and factor in closing costs, which can add 2–5% to your loan amount. This ensures you’re not overpaying.

Additionally, consider down payment strategies. Aiming for 20% minimizes mortgage insurance, boosting your loan approval chances and saving money upfront.

Finally, seek professional advice. Consulting a certified financial planner can tailor options to your needs, highlighting benefits like tax deductions on mortgage interest.

By following these tips, you empower yourself to make informed decisions, potentially lowering your mortgage burden and achieving financial security. Remember, exploring housing loan options wisely turns homeownership into a rewarding investment.

Negotiating Best Interest Rates

Did You Know? Home loans can save you thousands by negotiating interest rates effectively.

When you’re exploring housing loan options, negotiating the best mortgage rates is crucial for affordability. A lower mortgage rate means paying less over the loan’s lifetime, boosting your financial freedom. For instance, on a $300,000 mortgage, a 0.5% reduction could save you over $15,000 in interest.

To negotiate successfully, start by checking your credit score—experts from the Consumer Financial Protection Bureau recommend aiming for 760 or higher. Compare offers from multiple lenders; this competition often lowers rates.

Here are key steps you can take:

- Research market trends: Use tools like Freddie Mac’s rate tracker to understand current mortgage averages.

- Leverage your strengths: Highlight a strong down payment or steady income to argue for better terms.

- Ask about loans and discounts: Inquire if you qualify for government-backed loans or rate reductions for bundling services.

By mastering these tactics, you’ll secure a competitive mortgage, making homeownership more achievable and cost-effective. Remember, every percentage point counts in your loan journey. (148 words)

Managing Repayments Effectively

Did You Know? Over 70% of homeowners use home loans to finance their dream homes, but effectively managing repayments can significantly impact your financial future.

When you’re dealing with a home loan, effectively managing repayments is key to avoiding stress and building equity. As an expert in personal finance, I recommend starting by reviewing your mortgage terms to understand interest rates and payment schedules.

Here are practical steps you can take:

- Budget Wisely: Track your expenses to ensure your mortgage payments fit comfortably, freeing up funds for other goals.

- Make Extra Payments: Apply bonuses toward your loan principal to reduce interest over time, potentially shortening your loan term.

- Refinance When Needed: If rates drop, consider refinancing your mortgage to lower monthly costs, as advised by sources like the Consumer Financial Protection Bureau.

By mastering these strategies, you’ll not only handle your loans more efficiently but also improve your credit score and save thousands in interest. Remember, effective mortgage management empowers you to own your home sooner, turning loans into lasting assets. For more, check credible sites like Freddie Mac. (Word count: 148)

What is a home loan?

Did you know that a home loan is a key financial tool that helps millions buy homes each year?

A home loan, often called a mortgage, is a loan from a lender that lets you purchase property by borrowing money repaid over time with interest. For instance, you might secure a fixed-rate mortgage for stability or an adjustable-rate mortgage for potentially lower initial payments.

When exploring options, consider the current market rates to find the best fit. This empowers you to build equity and achieve homeownership benefits, like tax deductions.

According to experts at the Consumer Financial Protection Bureau, comparing mortgage offers can save you thousands in interest over the loan’s life. By choosing wisely, you gain financial security and long-term wealth.

How to qualify for a home loan?

Did you know that securing a home loan can be your gateway to owning a property and building equity?

To qualify for a mortgage, you need to meet key criteria that lenders evaluate. First, maintain a strong credit score—aim for 620 or higher—to show you’re a reliable borrower. Your income stability and debt-to-income ratio, ideally under 43%, are crucial for mortgage approval.

- Demonstrate steady employment: Lenders prefer at least two years in your current job.

- Prepare a down payment: Saving 3-20% of the home’s value reduces your loan amount and interest rates.

According to the Consumer Financial Protection Bureau, improving your credit can boost mortgage options, helping you secure better loans with lower rates. By qualifying, you gain financial stability and potential tax benefits, making homeownership more achievable.

What are typical home loan rates?

Did you know that home loan rates directly influence your mortgage affordability and long-term financial health?

Typical mortgage rates for home loans in 2026 range from 3% to 7%, depending on your credit score, location, and economic conditions, according to data from Freddie Mac. For instance, a strong credit profile might secure a lower mortgage rate, saving you thousands over the loan term.

- Factors to consider: Inflation and Federal Reserve policies often affect these rates, making it essential for you to compare mortgage options regularly.

- Benefits for you: Understanding loans helps you lock in favorable terms, reducing monthly payments and building equity faster.

Explore various loans through credible sources like bankrate.com to find the best mortgage deal tailored to your needs.

Home Loan: Your Key to Smarter Homeownership

As you explore home loan options, remember that selecting the right mortgage can save you thousands in the long run. We’ve covered essential steps like evaluating current mortgage rates, navigating the loan application process, learning from real user stories, and negotiating the best interest rates to secure your ideal home.

You can start by comparing various mortgages from trusted sources like Freddie Mac, which highlights current market trends, to find loans that fit your budget and goals. For instance, one user reduced their mortgage payments by 15% through savvy negotiations, showing how these strategies directly benefit you in today’s housing market.

By applying these insights, you’ll make informed decisions that lower costs and build equity faster. Refer to our guide on Exploring Home Loan Options for more tips, and share your experiences in the comments below to help others navigate their journey.