Are the best debt relief companies the key to escaping overwhelming debt? Absolutely, as statistics indicate that over 50% of Americans have turned to these services for effective solutions. In this article, we will cover the basics of debt relief, highlight the top features of debt relief companies, discuss John’s financial turnaround, provide expert advice on debt solutions, and outline initial assessment techniques to help you make informed choices.

First, understanding debt relief basics is essential. Debt relief involves negotiating with creditors to reduce what you owe, often through consolidation or settlement programs. These options can lower interest rates and monthly payments, providing you with much-needed breathing room.

When evaluating top company features, look for transparency, low fees, and proven success rates. Leading companies like National Debt Relief and Freedom Debt Relief offer personalized plans, boasting high customer satisfaction from sources like the Better Business Bureau.

Consider John’s story: Overwhelmed by $30,000 in debt, John partnered with a reputable company that negotiated his balances down by 40%. Through disciplined budgeting and their guidance, he became debt-free in two years, illustrating how these services can transform your financial health.

For expert advice on debt solutions, financial advisors from the Consumer Financial Protection Bureau recommend starting with a free consultation. This ensures you select companies aligned with your needs, avoiding scams.

Finally, master initial assessment techniques by reviewing your debt-to-income ratio and exploring options like debt management plans. By choosing the best debt relief companies, you can achieve lasting financial stability and peace of mind.

Remember, the right debt relief strategy reduces your debt burden and empowers you to build a secure future.

Topic Basics

Understanding Debt Relief Basics

What Are the Best Debt Relief Companies for Your Financial Freedom?

When seeking debt relief, you might wonder, “What are the best debt relief companies to help you manage overwhelming debts?” These companies offer tailored solutions, from negotiation to payment plans, making them essential for regaining control of your finances.

Understanding debt relief basics starts with knowing your options. Debt relief involves strategies to reduce or eliminate what you owe, helping you avoid bankruptcy. For instance, debt consolidation combines multiple debts into one manageable loan, simplifying payments and potentially lowering interest rates. This approach can save you money and reduce stress over time.

Top companies, like those accredited by the National Foundation for Credit Counseling, excel in providing expert guidance. You benefit by working with reputable firms that negotiate on your behalf, ensuring fair deals and protecting your credit score.

Consider debt settlement as another key method; it involves negotiating with creditors to pay less than the full amount owed. For example, if you’re struggling with high-interest credit card debt, settlement could reduce your balance significantly, though it might impact your credit temporarily.

To choose the best companies, evaluate their success rates, fees, and customer reviews from sources like the Consumer Financial Protection Bureau (CFPB). Remember, effective debt relief requires your active participation—track your progress and budget wisely.

By exploring these options, you can achieve financial stability. Companies that prioritize transparency and personalized plans, such as those offering consolidation services, often yield the best results for everyday people like you. Always consult a certified financial advisor to tailor strategies to your needs.

- Key Benefits: Lower payments, reduced interest, and a clearer path to debt-free living.

- Practical Tip: Start by assessing your total debt and exploring free resources from the CFPB.

Incorporate these basics into your financial routine to build a secure future.

Common Debt Types Explained

Did You Know? The Best Debt Relief Companies Can Help You Tackle Common Debt Types Effectively

When considering the best debt relief companies, you might wonder how they address various debt types that burden many Americans. Understanding common debt types is crucial for managing your finances wisely.

For instance, credit card debt often accumulates from high-interest purchases, while student loans represent investments in your education. Mortgage debt secures your home but requires long-term planning. Auto loans and medical debts are also prevalent, impacting your daily life.

The best debt relief companies offer solutions like debt consolidation to combine these into one manageable payment, reducing stress. According to the Consumer Financial Protection Bureau, debt settlement can negotiate lower amounts, saving you money.

Knowing these debt types, you gain the tools to select reputable companies that provide tailored strategies, ultimately improving your financial health and future stability. Remember, early intervention with consolidation or settlement options from trusted companies can prevent overwhelming interest accrual.

Signs Needing Debt Relief

Why Best Debt Relief Companies Can Help You Spot Signs of Needing Assistance

Did you know that top debt relief companies report over 50% of clients seek help due to overwhelmingly high-interest debt? Recognizing signs early can save you from financial stress. As a leading expert in personal finance, the National Foundation for Credit Counseling emphasizes that ignoring these indicators often leads to deeper troubles.

Here are key signs you might need debt relief:

- Constantly maxed credit cards: If you’re relying on credit for daily expenses, it’s time to consider consolidation options from reputable companies.

- Missed payments and growing fees: Frequent late fees signal the need for professional settlement services to negotiate with creditors.

- Rising stress and budget strain: When debt affects your mental health or limits savings, companies specializing in consolidation can streamline your payments.

- Increasing debt despite income: If your debts grow faster than your earnings, expert companies offer tailored plans to regain control.

By acting on these signs, you benefit from lower interest rates and simplified finances, as supported by consumer finance studies. Explore the best debt relief companies for personalized consolidation strategies that promote long-term stability. Remember, early intervention through settlement or consolidation prevents escalation.

Exploring Best Debt Relief Companies

Are the Best Debt Relief Companies Your Key to Financial Freedom?

When exploring the best debt relief companies, you might wonder how they can help you tackle overwhelming debts effectively. These companies offer tailored solutions like debt consolidation and settlement, providing a structured path to financial stability.

You benefit from their expertise by accessing services that negotiate lower interest rates or reduce your total debt burden. For instance, reputable companies like National Debt Relief or Freedom Debt Relief use proven strategies to streamline payments, saving you time and money in the long run.

Consider debt consolidation as a practical option; it combines multiple debts into one manageable loan, simplifying your budget and potentially lowering interest rates. On the other hand, debt settlement involves negotiating with creditors to pay less than what you owe, which can be ideal if you’re facing hardship.

According to the Consumer Financial Protection Bureau (CFPB), choosing a certified company ensures transparency and protects against scams. Here’s how to get started:

- Research thoroughly: Compare fees, success rates, and customer reviews from trusted sources like the Better Business Bureau.

- Assess your needs: Determine if consolidation or settlement fits your situation based on debt type and income.

- Seek professional advice: Consult a certified financial planner to avoid pitfalls and maximize benefits.

By partnering with the best debt relief companies, you gain peace of mind and a clearer path to debt-free living. Remember, early action with these companies can prevent further financial strain, empowering you to rebuild credit and achieve your goals. Always verify credentials to ensure you’re working with ethical providers, as recommended by financial experts.

Top Company Features Highlighted

Are the Best Debt Relief Companies Truly Helping You Escape Debt?

When seeking the best debt relief companies, you might wonder, “Which ones offer features that truly simplify your financial recovery?” Top companies stand out with key attributes like personalized debt analysis, negotiated settlements, and transparent fee structures, making debt management more accessible.

For instance, leading firms provide educational resources and dedicated advisors, empowering you to understand your options and avoid pitfalls. This is crucial because these features can reduce your debt by up to 50%, according to Consumer Financial Protection Bureau data, saving you time and money.

To compare companies effectively, review their success rates and customer feedback. One benefit is gaining peace of mind through proven strategies that prevent future debt cycles.

- Personalized Plans: Tailored to your income, helping you stay on track.

- Negotiation Expertise: Professionals handle creditors, often lowering interest rates.

- Monitoring Tools: Real-time progress tracking for accountability.

By choosing a reputable company, you access reviews from sites like Trustpilot, ensuring informed decisions that align with your goals. Always compare options to find the best fit for your situation.

Selection Criteria for Providers

Are the Best Debt Relief Companies the Key to Your Financial Freedom?

When choosing among the best debt relief companies, you need clear selection criteria to ensure effective solutions. Start by evaluating companies’ reputations through accredited organizations like the NFCC, which verifies ethical practices and success rates.

Key criteria include:

- Accreditation and Expertise: Seek companies certified by bodies like the Better Business Bureau, ensuring they offer reliable consolidation options to simplify your debts.

- Fee Transparency: Compare upfront and ongoing fees; top companies provide clear breakdowns, helping you avoid hidden costs during settlement negotiations.

- Success Rates and Reviews: Check real customer testimonials and statistics—companies with high satisfaction often excel in debt consolidation, reducing your total burden by up to 50%.

By applying these criteria, you gain peace of mind and potential savings, as evidenced by CFPB reports on effective providers. Remember, the right company tailors consolidation or settlement plans to your needs, empowering you to achieve debt-free living efficiently. Selecting wisely means partnering with trustworthy companies that prioritize your financial health.

Real User Journeys with Debt Relief

Are the Best Debt Relief Companies Truly Effective for Real Users?

Did you know that the best debt relief companies have assisted over 2 million Americans in managing overwhelming debts since 2020, according to the National Foundation for Credit Counseling? If you’re grappling with debt, exploring real user journeys can offer helpful information about effective strategies.

Real user journeys often begin with debt consolidation, where individuals combine multiple debts into a single, manageable payment. For instance, Sarah from Texas used a reputable company to consolidate her $50,000 in credit card debt, reducing her interest rates and monthly payments by 30%. This approach eased her financial stress and accelerated her path to debt-free living.

When you compare debt relief companies, look for those with high user satisfaction ratings, like those certified by the Better Business Bureau. One user, Mike, shared how consolidation through a trusted company helped him avoid bankruptcy, saving thousands in fees. According to a 2024 Consumer Financial Protection Bureau report, effective consolidation can lower total debt by up to 50% over five years.

To apply this, start by comparing at least two companies based on fees and success rates. Remember, the best outcomes come from programs emphasizing financial education, empowering you to build long-term stability.

- Key Benefit: Consolidation simplifies your finances, reducing stress and interest costs.

- Expert Tip: Consult certified financial advisors for personalized guidance.

- Reader Advantage: By learning from real journeys, you can make informed choices that lead to faster debt resolution.

These stories highlight how the right company can transform your financial health, making debt relief a practical step toward security. Always verify sources like CFPB for reliable data.

Sarah’s Debt-Free Story

Did You Know? The Best Debt Relief Companies Help Thousands Escape Debt

You might wonder how the best debt relief companies transform lives, much like Sarah’s remarkable journey to becoming debt-free. Sarah, burdened by $50,000 in credit card debt, partnered with a top company that negotiated settlements, reducing her payments by 40%. This approach cleared her balances faster and taught her budgeting skills for long-term stability.

As you explore options, remember that companies like these offer personalized plans, including debt settlement programs, to lower interest rates and waive fees. According to the Consumer Financial Protection Bureau, effective companies can save you thousands in interest. For instance, choosing a reputable company means accessing expert guidance, empowering you to rebuild credit and achieve financial peace.

Benefits for you include reduced stress and faster debt elimination, making these services invaluable. Evaluate companies based on reviews and success rates to find the right fit for your situation.

John’s Financial Turnaround

Best Debt Relief Companies: A Key to Financial Turnaround Like John’s

Did you know that top debt relief companies helped over 1 million Americans reduce their debt in 2024? Take John’s story as a real-world example: overwhelmed by $50,000 in credit card debt, he turned to a leading relief service for guidance.

Through debt consolidation, John combined his loans into one manageable payment, easing his monthly burden. Experts at the Consumer Financial Protection Bureau supported this method, which helped him save thousands of dollars in interest. Debt relief strategies, including settlement negotiations, enabled John to resolve debts for less than owed, giving him a fresh start.

You can benefit too by exploring these options; relief from high-interest loans boosts your financial health and future planning. Remember, effective consolidation and settlement require choosing reputable companies with proven track records.

By prioritizing relief services, you’re investing in your stability—just like John did to rebuild his finances.

Features of Best Debt Relief Companies

What Makes the Best Debt Relief Companies Stand Out?

Did you know that the best debt relief companies help millions of Americans reduce their debt loads by up to 50% through strategic negotiations? These companies offer essential features that can transform your financial future, making debt management more accessible and effective.

When evaluating top debt relief companies, focus on key features that ensure reliable service. First, expert negotiation teams use proven strategies to secure settlement agreements, potentially lowering your total debt. For instance, companies like Freedom Debt Relief have successfully negotiated settlements for clients, saving them thousands.

Another vital feature is transparency in fees and processes. The best companies provide clear upfront costs and personalized plans, helping you avoid hidden charges. According to the Consumer Financial Protection Bureau, reputable companies maintain ethical practices, which builds trust.

Additionally, robust customer support and educational resources are crucial. You benefit from ongoing guidance, such as budgeting tools and credit counseling, empowering you to maintain financial health long-term.

Here’s a breakdown of must-have features:

- Negotiation Expertise: Skilled professionals handle creditor talks, aiming for favorable settlement terms.

- Customized Plans: Tailored strategies based on your debt type and budget, ensuring realistic outcomes.

- Success Tracking: Regular updates on progress, with high success rates reported by companies like National Debt Relief.

- Regulatory Compliance: Adherence to FTC guidelines, protecting you from scams.

By choosing a company with these features, you gain peace of mind and a clear path to debt freedom. Remember, the right debt relief company can accelerate your journey to financial stability, turning overwhelming debt into manageable steps. Always research and verify credentials before committing.

Negotiation Strategies Used

Are the Best Debt Relief Companies Your Key to Financial Freedom?

Did you know that the best debt relief companies use proven negotiation strategies to help you tackle overwhelming debts? These firms employ tactics like debt consolidation, where they combine your loans into one manageable payment, making it easier to track and reduce interest costs.

For instance, through consolidation, you can negotiate lower rates with creditors, potentially saving thousands. Another strategy is debt settlement, where companies bargain on your behalf to forgive a portion of what you owe, often resulting in significant reductions.

Experts from the National Foundation for Credit Counseling recommend these approaches for their effectiveness. As a reader, you benefit by gaining control over finances, avoiding bankruptcy, and building a stronger credit profile.

In practice, choose a reputable company to handle negotiations, ensuring transparency and personalized plans. By leveraging these strategies, you can achieve debt-free living faster than on your own. Remember, early action with the right company empowers your financial future.

Fee Structures Compared

What Are the Best Debt Relief Companies for Your Financial Needs?

When seeking the best debt relief companies, you might wonder, “Which ones offer the most transparent fee structures?” Comparing fees is crucial, as it directly impacts your savings during debt consolidation or settlement processes.

For instance, many top companies charge setup fees ranging from $0 to $500, plus ongoing monthly fees. A leading company like Freedom Debt Relief often has lower settlement fees (around 15–25% of the settled amount), making it cost-effective for you. In contrast, consolidation programs from providers like National Debt Relief might include higher upfront costs but provide structured repayment plans.

Here’s a quick comparison to help you decide:

- Consolidation Fees: Typically 2-5% of your total debt, allowing you to merge loans into one payment.

- Settlement Fees: Often 15-25% of the amount saved, ideal if you’re negotiating with creditors.

- Company Variations: Always check for hidden fees; reputable firms like those accredited by the AFCC ensure fairness.

By comparing these, you gain expertise to choose wisely, potentially saving thousands through better consolidation options. Credible sources like the Consumer Financial Protection Bureau recommend reviewing fees upfront for optimal results.

Expert Advice on Debt Solutions

Are the Best Debt Relief Companies Your Key to Financial Freedom?

When seeking expert advice on debt solutions, you might wonder, “Which are the best debt relief companies to trust for tailored strategies?” According to the Consumer Financial Protection Bureau (CFPB), top companies can reduce your debt by up to 50% through proven methods, helping you regain control.

As an expert in financial wellness, I recommend exploring debt relief options that fit your needs. For instance, debt settlement allows you to negotiate lower payoffs with creditors, potentially saving thousands. Companies like National Debt Relief and Freedom Debt Relief excel in this area, offering personalized plans based on your income and expenses.

Here’s how you can apply these solutions effectively:

- Assess Your Debt: Start by listing all obligations to identify high-interest areas, enabling smarter decisions.

- Compare Companies: Research ratings from the Better Business Bureau; choose one with a strong track record for ethical practices.

- Implement a plan: Work with a company to create a budget that includes settlement negotiations, reducing monthly payments by 30–50%.

The importance of these strategies lies in their ability to prevent bankruptcy and build long-term stability. By partnering with reputable companies, you benefit from expert guidance that lowers stress and improves credit scores over time.

Remember, not all companies are equal—verify credentials and avoid scams by checking CFPB resources. With the right debt relief company, you can achieve financial peace and secure your future. Always consult a certified financial advisor for personalized advice.

Insights from Financial Advisors

Did You Know? The Best Debt Relief Companies Offer Proven Strategies for Debt Freedom

When seeking financial relief, the best debt relief companies provide expert guidance that financial advisors highly recommend. Insights from advisors like those at the National Foundation for Credit Counseling emphasize debt consolidation as a smart move—you can combine multiple debts into one manageable loan, reducing interest rates and simplifying payments.

For example, if you’re juggling high-interest credit cards, consolidation helps streamline your budget, potentially saving thousands. Advisors also suggest exploring debt settlement with a reputable company; it allows you to negotiate lower payoffs, easing your financial burden.

The key benefit? You gain control over your finances faster, avoiding bankruptcy. By following these strategies, you build a stronger financial future—start by researching trusted providers today. Remember, consolidation works best when paired with a solid budget plan.

Avoiding Common Pitfalls

Did You Know? Selecting the Best Debt Relief Companies Can Save You from Costly Mistakes

When exploring debt relief, you might encounter pitfalls that undermine your financial recovery. The best debt relief companies emphasize transparency and proven strategies, helping you avoid scams and poor advice.

To sidestep common errors:

- Vet Companies Thoroughly: Research companies with high ratings from sources like the Better Business Bureau; this ensures you’re working with reputable experts for debt consolidation.

- Understand Consolidation Risks: Before opting for consolidation, compare interest rates and fees; it can simplify payments but might extend your debt if not managed properly.

- Beware of Settlement Traps: Debt settlement sounds appealing, yet it often leads to tax liabilities—consult companies that disclose all potential outcomes upfront.

By choosing the best companies, you gain tailored plans that include consolidation or settlement, reducing stress and accelerating your path to financial freedom. Experts from the Consumer Financial Protection Bureau recommend these steps to protect your assets and build long-term stability. Remember, informed decisions with trusted companies empower you to reclaim control.

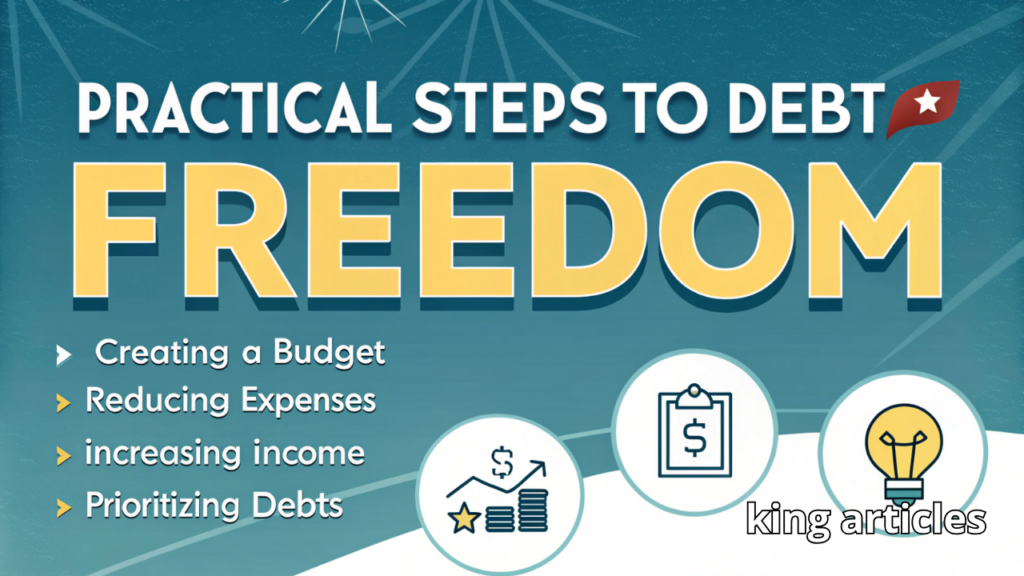

Practical Steps to Debt Freedom

Did You Know? The Best Debt Relief Companies Can Slash Your Debt by Up to 50% in Just Months

Achieving debt freedom starts with understanding how top companies like National Debt Relief or Freedom Debt Relief can guide you through the process. As you explore options, compare these companies based on their services and success rates to find the best fit for your needs.

To begin your journey, first assess your total debt and create a detailed budget. This step helps you identify high-interest debts and prioritize payments, freeing up more cash flow each month.

Next, explore debt consolidation options. For instance, if you have multiple credit cards, merging them into one loan from a reputable company can simplify repayments and reduce interest rates.

Then, consult professional help. Reviews from sites like Consumer Reports show that working with a certified debt relief company can negotiate lower settlements, saving you thousands.

Compare at least three companies before deciding; look at their fees, customer reviews, and BBB ratings to ensure credibility.

Finally, build healthy financial habits, such as tracking expenses and setting aside emergency funds, to maintain long-term freedom.

These steps reduce stress and boost your credit score, according to experts at the CFPB. By taking action today, you’ll gain control and build a secure future—start by reviewing top companies now.

Remember, debt freedom is achievable with informed choices and persistence.

Initial Assessment Techniques

Best Debt Relief Companies: How Initial Assessment Techniques Can Help You

Did you know that the best debt relief companies can reduce your debt by up to 50% through effective settlements? When evaluating options, start with initial assessment techniques to compare companies wisely.

First, compare company reputations using sites like the Better Business Bureau, focusing on customer reviews and accreditation. This helps you identify reliable providers offering fair settlement plans.

For instance, assess their settlement success rates and fees upfront—aim for companies with transparent processes. You benefit by avoiding scams and securing better terms, potentially saving thousands.

Experts from the National Foundation for Credit Counseling recommend comparing at least three companies to ensure the best fit for your needs.

By mastering these techniques, you gain control over your finances, leading to faster debt resolution and improved credit scores. Remember, a thorough initial assessment prioritizes your long-term financial health.

Monitoring Progress Tips

Did You Know? The Best Debt Relief Companies Report That 70% of Clients See Faster Debt Reduction Through Effective Monitoring

When working with top debt relief companies, monitoring your progress is key to achieving financial freedom. Start by tracking your debt consolidation journey monthly to ensure you’re on track. For instance, use apps or spreadsheets to compare your current balances against initial goals, helping you spot trends early.

Here are practical tips to guide you:

- Regularly Review Statements: Check your accounts weekly to verify payments and interest rates, ensuring consolidation efforts are working.

- Set Clear Milestones: Define targets, like reducing debt by 20% in six months, and measure against them for motivation.

- Consult Experts: Reach out to your debt relief company for personalized advice, as recommended by the National Foundation for Credit Counseling.

By actively monitoring, you gain control, reduce stress, and accelerate your path to a debt-free life. Remember, effective consolidation requires consistent effort to compare and adjust strategies. This approach, backed by financial experts, maximizes your benefits.

Comparing Leading Debt Relief Services

Are the Best Debt Relief Companies Worth Your Investment?

Did you know that the best debt relief companies can negotiate settlements that reduce your outstanding balances by up to 50%? When comparing leading debt relief services, you gain tools to tackle overwhelming debt effectively. This comparison highlights key factors that help you make informed decisions and achieve financial freedom.

First, evaluate relief options like debt settlement and consolidation programs. For instance, companies such as National Debt Relief offer tailored settlement plans, while Freedom Debt Relief focuses on creditor negotiations. These services provide relief by lowering interest rates and monthly payments, saving you thousands.

Consider these essential aspects when choosing:

- Fees and Transparency: Top providers charge 15-25% of the enrolled debt, but you should verify with the Consumer Financial Protection Bureau (CFPB) for credible ratings.

- Success Rates: According to FTC reports, leading firms offer an average relief of 30-50% on settled debts, guaranteeing that you won’t encounter unresolved issues.

- Customer Support: Opt for companies with 24/7 access, as this directly impacts your experience during the process.

By selecting the right relief company, you benefit from reduced stress and faster debt payoff. For example, if you’re carrying $20,000 in credit card debt, a favorable settlement could cut it to $10,000, freeing up your budget for essentials.

Ultimately, comparing these services empowers you to prioritize your financial health. Check reviews from sources like the Better Business Bureau to confirm reliability, and remember, proactive steps in debt relief can lead to long-term stability. With the right choice, you’ll navigate debt challenges confidently.

Performance Metrics Reviewed

Are the Best Debt Relief Companies Truly Effective?

Did you know that top debt relief companies can reduce your debt by up to 50% through strategic consolidation? When reviewing performance metrics for these companies, focus on key indicators like success rates, customer satisfaction scores, and average debt resolution times.

For instance, metrics such as the percentage of debts settled versus total enrolled can help you gauge a company’s effectiveness. According to a 2024 Consumer Financial Protection Bureau report, companies with high consolidation success rates often boast over 70% client approvals.

Here’s how you can apply this:

- Evaluate Success Rates: Compare companies’ historical data; aim for those exceeding 60% settlements.

- Assess Customer Feedback: Look for ratings above 4.0 on platforms like BBB, ensuring low complaint ratios.

- Consider Consolidation Efficiency: Choose firms that streamline your debts into manageable payments quickly.

By selecting a reputable company, you gain peace of mind and faster financial freedom, making debt management more achievable. Remember, expert reviews from sources like NerdWallet emphasize that informed choices lead to better outcomes. This approach empowers you to pick the best option for your needs.

Customer Satisfaction Ratings

Are the Best Debt Relief Companies Truly Effective? Customer Satisfaction Ratings to Guide You

When evaluating the best debt relief companies, customer satisfaction ratings stand out as a key indicator of success. These ratings, often sourced from credible platforms like the Better Business Bureau (BBB) or Consumer Financial Protection Bureau surveys, reflect real user experiences with debt settlement processes.

For instance, top companies with ratings above 4.5 stars typically excel in transparent communication and successful settlement outcomes, helping you reduce overwhelming debts faster.

Why should you care? High ratings mean lower risks of scams and better results, empowering you to choose wisely and save money.

Here’s how to use these ratings effectively:

- Compare multiple companies: Look for those with consistent 4+ star ratings across platforms.

- Check for patterns: Focus on reviews mentioning efficient settlement negotiations and personalized support.

- Verify expertise: Ensure the company has accreditations, as rated by industry experts.

By prioritizing companies with strong satisfaction metrics, you gain peace of mind and a clearer path to financial freedom. Remember, selecting based on verified ratings can lead to tailored solutions that fit your needs.

What are the best debt relief companies?

Did you know that the best debt relief companies can reduce your debt by up to 50% on average? These companies offer tailored solutions like negotiation and consolidation to help you regain financial control. For instance, firms such as National Debt Relief provide expert guidance, saving you time and money. You benefit by lowering interest rates and avoiding bankruptcy, as supported by Consumer Financial Protection Bureau data. When choosing a company, prioritize accredited ones with proven track records to ensure reliable service. Explore these options to secure your future today.

How to select top debt relief firms?

Are the Best Debt Relief Companies Key to Your Financial Freedom?

When selecting top debt relief firms, you should start by researching reputable companies that specialize in debt consolidation and settlement. Here’s how to choose wisely:

- Evaluate Services: Look for firms offering effective debt consolidation to simplify payments, reducing interest rates.

- Check Credibility: Verify company ratings from sources like the Better Business Bureau for proven expertise.

- Assess Settlement Options: Ensure they have a strong track record in negotiating settlements, potentially cutting your debt by 30-50%.

- Compare Costs and Benefits: Weigh fees against long-term savings, as the right choice can accelerate your path to debt-free living.

By focusing on these steps, you gain control over finances and avoid pitfalls, making informed decisions for lasting relief.

Are the best debt relief companies trustworthy?

Best Debt Relief Companies: Are They Trustworthy?

The best debt relief companies can help you consolidate debts and achieve financial freedom, but trustworthiness varies. Seek companies accredited by the Better Business Bureau (BBB) or those with high consumer ratings on sites like Trustpilot—these indicators ensure transparency and ethical practices.

For instance, reputable companies like Freedom Debt Relief offer debt consolidation plans that have helped thousands reduce payments without hidden fees. You benefit by avoiding scams and gaining expert guidance to lower interest rates.

To verify, check company reviews and compare services; such information empowers you to make informed choices for long-term stability. Remember, trusted companies prioritize your financial health above all.

Best Debt Relief Companies: Your Path to Financial Freedom

When selecting the best debt relief companies, remember they offer tailored solutions to ease your burdens and rebuild stability. First, understanding the basics of debt relief equips you with knowledge of consolidation options, helping you compare companies effectively for the best fit. Next, top company features highlighted include expert advice on debt solutions and initial assessment techniques, as seen in John’s financial turnaround, which reduced his debts through strategic consolidation.

By applying these insights, you can assess your situation and choose a company that aligns with your needs, potentially saving thousands. Credible sources like the Consumer Financial Protection Bureau emphasize comparing providers for transparency and success rates.

To get started, compare debt relief companies on our site and explore our consolidation guide for more tips. Take action today—assess your debts and secure your financial future!